Airwallex vs Equalsmoney Comparison for UK Businesses

Compare Equalsmoney vs Airwallex for UK businesses. Discover fees, features, and how Wise Business can save you money on global payments.

Looking for a new business account? You might want to consider a digital solution.

App-first banking has rapidly increased in popularity over the last few years, with around 21.5 million British people using a digital-only bank account in 2024. This is around 40% of the UK population.¹

There are a growing number of digital banks out there, many offering dedicated solutions for businesses as well as personal customers.

Two of the most popular options for SMEs are Wise Business and Revolut, but how do they compare? To help you choose the right solution for your business, we’ll run through everything you need to know here in this guide. This includes fees, features and more.

To make it easier to compare Wise Business and Revolut Business at a glance, we’ve put together a table covering all the important stuff. This includes things like fees, currencies and key account features, so you can see how the two providers stack up side-by-side.

| Service | Wise Business | Revolut Business² |

|---|---|---|

| Account opening fee | £45 | None |

| Monthly subscription fee | None | - £10 to £90 a month for companies (varies by plan) - £0 to £45 a month for freelancers3 |

| Currency account details (how many currencies?) | 8+ (GBP, EUR, USD, CAD, RON and more) | 34 (GBP, EUR, USD) |

| Hold money (how many currencies?) | 40+ | 34+4 |

| International payments | ✅ | ✅ |

| Business card | ✅ | ✅ |

| Expenses cards | ✅ | ✅ |

| Overdraft | ❌ | ❌ |

| Interest product | Variable on GBP, EUR and USD balances | Up to 3.51% AER (variable) on Savings² |

| Multi-user access | Yes | Yes |

| Accounting integrations (which providers?) | Xero, QuickBooks, FreeAgent, FreshBooks + Oracle NetSuite | Xero, QuickBooks, FreshBooks, ZohoBooks, FreeAgent + Sage |

| API | Yes | Yes |

| Bulk payments | Yes | (excl. Basic plan) |

Revolut offers a considerable number of features and services designed for business needs, although it depends what plan you’re on.

Revolut Business plans include:²

The Basic plan gives you access to standard features, including, multi-currency accounts, Revolut Business cards, IBANs for global transfers, accounting app integration, expense management and the option to create invoices. You can also use Revolut to accept payments online.

But it also comes with lots of limits, such as just 5 fee-free local payments and 10 fee-free business international payments a month2 To exceed this limit, there are fees involved - we’ll look at these next.

If you upgrade to a more expensive plan, you can unlock features such as:

Revolut Business account reviews from existing customers are pretty good. The company gets a 4.5 rating on TrustPilot from over 204,000 reviews (includes reviews from personal account customers).5

| Read more: Tide vs Revolut Business: comparison for the UK |

|---|

Alongside the monthly fee for paid plans, Revolut also has fees for many of its other services. Depending which plan you’re on, you’ll get a monthly fee-free allowance for things like international payments and currency exchange. But above this, fees will apply.

Let’s take a look at the other charges you need to know about as part of Revolut Business pricing (based on the Basic plan):6

| Service | Fee (once fee-free monthly allowance exceeded) |

|---|---|

| Send local payments | £0.20 per payment Free to Revolut accounts |

| Send international payments | £5 per payment |

| Receive international payments | Free for payments in GBP, EUR, USD and CHF £5 per payment otherwise7 |

| ATM withdrawals | 2% |

| Currency exchange | 0.6% fee when exceeding your allowance. 1% fee when exchanging outside market hours |

| Revolut business card | Free (delivery charge may apply) |

| Pros ✅ | Cons ❌ |

|---|---|

|

|

| Read more: Revolut vs Starling Business Account: comparison for the UK |

|---|

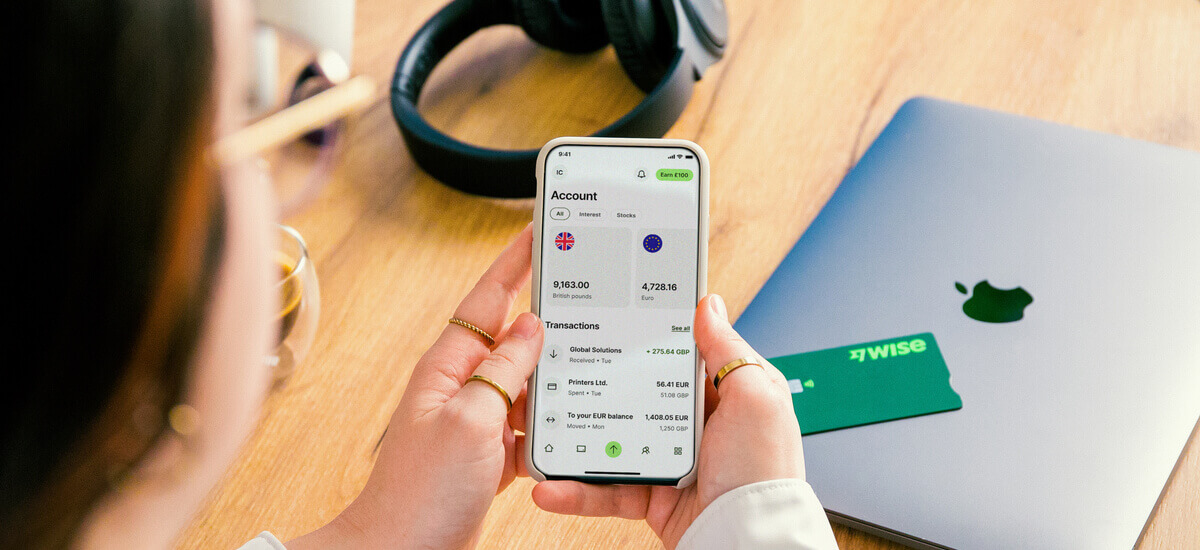

The Wise Business account is ideal for companies that trade internationally, or who buy goods or employ people from other countries.

There’s just one powerful account, with no monthly subscription fees. Features include:

With Wise Business you can even earn a return on the money you hold in multiple currencies. With Wise Interest, you can get a variable rate on your GBP, EUR and USD balances held in your Wise Business multi-currency account.

Capital at risk. Growth not guaranteed. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website. Capital at risk. Current rates do not guarantee future growth.

Wise is UK regulated, and uses sophisticated security measures to keep your business details and finances safe.

Over on TrustPilot, Wise Business account reviews are positive - giving Wise a score of 4.3 based on over 257,000 reviews.8

Get started with

Wise Business 🚀

Here are the fees and charges you need to know about for the Wise Business multi-currency account:

| Service | Fees |

|---|---|

| Open Business account | £45 one time fee |

| Receive payments | - Free in 8+ major currencies - $6.11 for receiving USD wire payments - €2.39 for receiving EUR SWIFT payments - £2.16 for receiving GBP SWIFT payments |

| Send payments | From 0.33% |

| ATM withdrawals | - Free up to £200 a month (max. 2 withdrawals) - 1.75% + £0.50 above that |

| Currency exchange | Mid-market exchange rate, with no mark-ups |

| Pros ✅ | Cons ❌ |

|---|---|

|

|

It’s pretty simple to open a Wise business account online. You’ll just need some details, documents and a few minutes of your time.

Just follow these steps:

And that’s it. Once your account is opened, you’ll be able to start making use of its features and tools right away. This includes ordering Wise Business cards, making transfers and sending invoices to your global clients and customers.

And that’s it - our rundown of Wise Business vs. Revolut Business. We’ve compared the two providers on all the things that matter, including pricing and fees, features and services, and the pros and cons of both companies.

You should now have all the info you need to choose the right solution for your business.

Whichever one you go for, one thing’s for sure - the future of business banking is digital.

Sources used:

Sources last checked on date: 12-May-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare Equalsmoney vs Airwallex for UK businesses. Discover fees, features, and how Wise Business can save you money on global payments.

Compare Airwallex vs Payoneer pricing and features to find the best option for your international payments. See how Wise offers an alternative.

Find out how to send money from PayPal to Payoneer here in this handy guide for UK businesses, covering everything you need to know.

Can you use Airwallex in the US? Find out here in our essential guide for UK businesses, covering everything you need to know.

Can you use Airwallex in the UAE? Find out here in our essential guide for UK businesses, covering everything you need to know.

Learn how to create a Payoneer account in the UK with this step-by-step 2025 guide. Discover account types, requirements, fees and alternatives.