Does MoneyGram work in China?

Is MoneyGram available in China? Yes! This article will explain how MoneyGram works in China and how you can send money from China.

You’ve probably never heard of Fapiao before. Fapiao are very much like invoices. In fact, they can be considered as invoices as well as tax and VAT records. In the event that you are a traveller in China or if you’re planning to expand your business to China, you’ll have to deal with fapiao sooner or later. Chinese fapiao is a rather complicated system, and it can seem overwhelming for foreigners. So on that note, we’re going to explain all you need to know about fapiao in China.

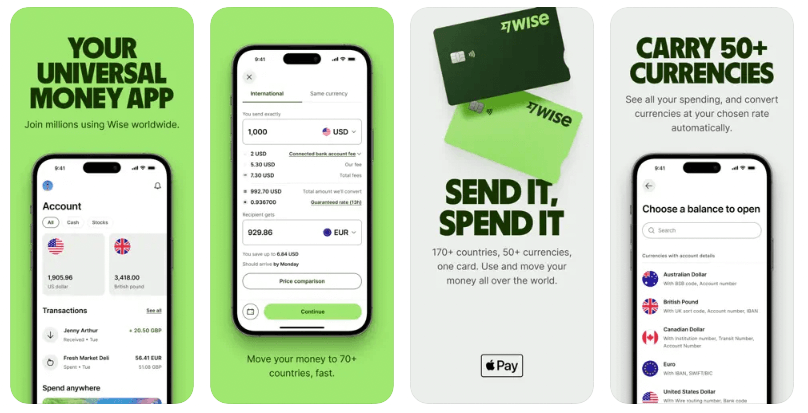

Expats are usually also in need of receiving and sending money internationally, be sure to check out Wise. With Wise, you can transfer your legal Chinese earnings out of China on the fly. Additionally, you can always hold and convert the right kind of currency for the country you’re living in, whether it is China, the USA, or other countries.

Send money home using Wise today

| Table of contents |

|---|

Fapiao (in Chinese: 发票) refers to the receipt and payment vouchers issued and collected during the purchase and sale of goods, provision or acceptance of services and engagement in other business activities. The tax authorities of the State Council of the People's Republic of China are uniformly responsible for the management of invoices throughout the country¹.

Issuing organization of fapiao:

Special VAT fapiao are printed by enterprises determined by the competent tax authorities under the State Council. Other fapiao shall be printed by enterprises determined by the tax authorities of provinces, autonomous regions and municipalities directly under the Central Government in accordance with the provisions of the competent tax authorities under the State Council. It is prohibited to print, forge or alter ‘fapiao’ privately¹.

What's included in a fapiao?

A fapiao typically contains fapiao name, fapiao code and number, fapiao coupon and purpose, customer name, bank and account number, product name or business project, unit of measurement, quantity, unit price, capital and case amount, invoicer, invoice date, invoicing company (or individual), company name (or seal), etc².

To avoid duplicate or missed invoices, each fapiao needs to have a distinct operative account number³.

For individuals:

For companies:

For government:

There are eight types of Fapiao available in China⁴:

Electronic fapiao is currently the most popular type of fapiao in China. Among the many benefits of e-fapiao are real-time, interactive, affordable, and simple storage. The e-fapiao issued through the new VAT fapiao management system has the same legal effect as the paper fapiao supervised by the tax authorities⁵.

You already have a general idea of the close connection between taxation and fapiao from the previous paragraphs. The following is a summary of several aspects:

When trading with overseas enterprises, Chinese foreign trade enterprises are generally required to issue fapiao in accordance with the requirements of customs and taxation.

Fapiao is the basis for tax classification of export commodities by the Customs and must be provided when the Customs implements tax inspection to ensure that enterprises can declare customs normally. In addition, foreign trade enterprises can use VAT Fapiao as the export tax refund declaration vouchers⁶.

For foreign-invested enterprises and foreign enterprises in China, the Interim Provisions on the Management of Fapiao for Foreign-Invested Enterprises and Foreign Enterprises issued by the former State Administration of Taxation in 1991 have been repealed¹.

However, foreign-invested enterprises and foreign enterprises, like Chinese enterprises, are required to issue fapiao and pay taxes in accordance with the Provisional Regulations of the People's Republic of China on Value-added Tax, the Provisional Regulations of the People's Republic of China on Business Tax, the Income Tax Law of the People's Republic of China for Foreign-invested Enterprises and Foreign Enterprises, and other laws or regulations in China⁷.

Wise is a safe and reliable international money transfer tool for expats and foreign enterprises in China to send RMB overseas. There are more than 160+ countries you can send money to! More importantly, Wise uses mid-market exchange rates, for sending money internationally or converting currencies and a small upfront conversion fee.

When you are receiving money or holding account details in AUD, CAD, EUR, GBP, HUF, NZD, SGD, TRY and USD, you won’t be charged any fees. Wise is completely working both online and through an app -- simple to use -- all at the touch of a fingertip.

Wise is used by more than 16 million people globally for various services, including international money transfers. Create a Wise account right now and discover how you can use it!

*This service is provided in partnership with a licensed third party payment provider in China.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Is MoneyGram available in China? Yes! This article will explain how MoneyGram works in China and how you can send money from China.

Check what is Panda Remit, is it safe? Learn its fees and limits to choice of currencies. Get to know Wise, a good alternative for sending money from China!

Everything about how to open a Shanghai Commercial Bank account, steps, required documents, charges and fees of deposit, international transfers

What is the Alipay transaction limit to send and receive money? Is there a limit for foreigners using Alipay? How to increase Alipay maximum? Check out the answ

Bank of China credit cards guide: apply requirments, hoe to apply, how many types of credits card does Bank of China have? Key features, fees and benefits of th

Explore JP Morgan Chase Bank locations in China, and the step guide on how to use it to transfer money out of China, along with fees and limits.