Does MoneyGram work in China?

Is MoneyGram available in China? Yes! This article will explain how MoneyGram works in China and how you can send money from China.

An international bank card is often needed by expats in China where foreigners can sometimes find it harder to manage their earnings and finance than the local people. Starting business in China since 1921¹, J.P. Morgan Chase Bank from the USA is one of the popular options for foreign nationals. You can use it for payments, asset management, cross-border remittance, etc. Today, let’s look at JP Morgan Chase Bank locations in China, and give you a step-by-step guide on how to use it to transfer money out of China.

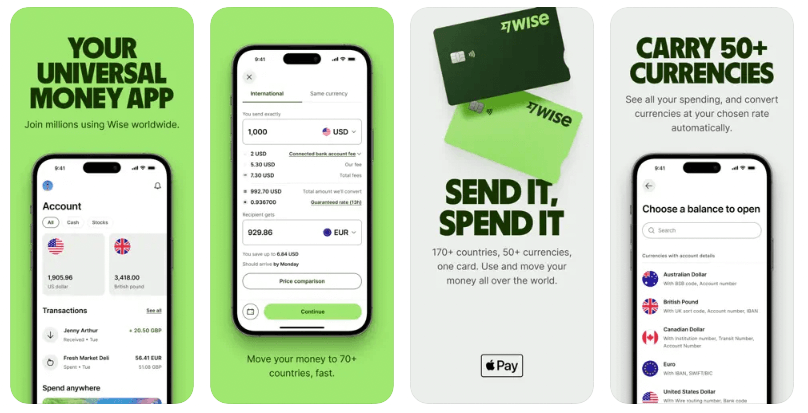

Another way to send money overseas is using Wise, an online global money transfer company based in the UK. Different from traditional banks, Wise uses the mid-market rate for international money transactions. There’s the Wise multi-currency account to receive, send and convert currencies in one place -- cheap and fast. All you have to do is register for a Wise profile today!

Send money home using Wise today

Yes, it is. JP Morgan's history in China began from the opening of an office in Shanghai in 1921 by one of its predecessor firms¹.

Its integrated financial services include corporate banking, global corporate payments, securities services, marketing, sales and research, institutional Investing, commercial banking and asset management¹.

J.P. Morgan Chase Bank is called “摩根大通中国”, (Pinyin: mó gēn dà tōng zhōng guó)“摩根大通” or “摩根银行” in China.

J.P. Morgan Chase Bank China provides a full range of financial services to local and multinational corporations, financial institutions and government agencies in China through a network of locations in Beijing, Shanghai, Tianjin, Guangzhou, Chengdu, Harbin, Suzhou and Shenzhen¹.

Below, we list some of the offices and branches of Chase Bank in China¹. You can visit J.P. Morgan Chase Bank China official website for more information, and to find a local location in your city or near you.

| Locations | City | **Address ** | Phone |

|---|---|---|---|

| JPMorgan Chase Bank (China) Company Limited | Beijing | 19th Floor, Beijing Winland International Finance Center, No.7, Jinrong Street, Xicheng District, Beijing | +86 10 5931 8000 |

| JPMorgan Chase Bank (China) Company Limited Beijing Branch | Beijing | 19 and 20F, Beijing Winland International Finance Center, No.7, Jinrong Street, Xicheng District, Beijing | +86 10 5931 8000 |

| JP Morgan Chase Bank (China) Company Limited Shanghai Branch | Shanghai | 45th – 48th Floor, Shanghai Tower, No. 501, Middle Yincheng Road, Pudong New Area, Shanghai | +86 21 5200 2288 |

| JPMorgan Chase Bank (China) Company Limited Guangzhou Branch | Guangzhou | Unit 2, 16th Floor, Hejing International Finance Place, No. 8 Huaxia Road, Pearl River New City, Guangzhou, Guangdong Province | +86 21 5200 2288 |

| JPMorgan Chase Bank (China) Company Limited Shenzhen Branch | Shenzhen | Unit No. 03, 26/F, Tower 3, Kerry Plaza, No. 1-1 Zhongxin 4th Road, Futian District, Shenzhen, Guangdong Province | +86 755 3299 0720 |

| JPMorgan Chase Bank (China) Company Limited Chengdu Branch | Chengdu | Unit 6,7&8, 16th Floor, Shangri-La Centre No.9 Binjiang Dong Road, Jinjiang District, Chengdu, Sichuan Province | +86 28 6293 5188 |

| JPMorgan Chase Bank (China) Company Limited Suzhou Branch | Suzhou | Room 701-702, 24B Harmony Times Square, Suzhou Industrial Park, Suzhou, Jiangsu Province | +86 512 6799 5788 |

| JPMorgan Chase Bank (China) Company Limited Tianjin Branch | Tianjin | Unit 3808, 38th Floor, Tianjin World Financial Center,No.2 North Dagu Road, Heping District, Tianjin | +86 22 2317 6666 |

| JPMorgan Chase Bank (China) Company Limited Harbin Branch | Harbin | Unit G, 22nd Floor, Always Development Plaza, No. 15, Hongjun Road, Nangang District, Harbin, Heilongjiang Province | +86 451 8732 5288 |

With JPMorgan Chase Bank wire transfers, you have a daily maximum send amount of $250,000². But you’ll need to confirm with a J.P. Morgan branch in China to inquire about the limits for sending money abroad, and about the international money transfer fees and exchange rates to be used.

Wise can help expats in China to send their legal income outside of China simply and securely. Foreign nationals, who are working in China or had a job in China before, with a valid tax record issued by the China tax authority, can use Wise to send from CNY money overseas.

If it is your first time to send CNY using Wise, you’ll need to get verified with the necessary documents, including:

To support your money transfer out of China with Wise, you need to top up your Wise balance. Choose one way from below that works for you:

Wondering how long it takes for the payee to get the money from China? It usually takes just 1 working day for Wise to receive your money, and up to 2 business days to convert it and send it out. When you are setting up a transfer, Wise will give you an estimate for how long it will take.

Founded in 2011, Wise is the choice for more than 16 million global users for making financial transactions internationally. Receiving and sending money like a local, having 8 currency account details, and holding and converting 40+ currencies, Wise offers you the multi-currency account for traveling around the world easily and affordably.

Wise supports sending money to 160+ countries in the world, including China. Sending money from China abroad is fast and cheap, via online or the mobile app, using the middle-market exchange rate. For expats in China, Wise is one of the most useful tools to top up your Alipay, Wechat Pay and Unionpay bank cards.

Open a Wise account for free right now! As soon as you do, your money is available to receive or send whenever you wish.

*This service is provided in partnership with a licensed third-party payment provider in China.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Is MoneyGram available in China? Yes! This article will explain how MoneyGram works in China and how you can send money from China.

Check what is Panda Remit, is it safe? Learn its fees and limits to choice of currencies. Get to know Wise, a good alternative for sending money from China!

What is the Alipay transaction limit to send and receive money? Is there a limit for foreigners using Alipay? How to increase Alipay maximum? Check out the answ

How to open a business bank account in China as a foreigner? This article explains the details for a foreign-invested enterprise to open a business account.

Can you transfer Money from Alipay to PayPal? Yes, but very complicated. Here’s an easy and fast way to transfer money from Alipay to PayPal, and send money out

Is Alipay free to use? How much does Alipay charge in fees for a foreign credit card to make purchases and transactions? Read on to find the answers.