Is Wise card safe in Ireland and abroad?

This article is all about the safety of Wise card. Discover all the security measures you can add to your Wise account and card.

There’s no doubt that PayPal is one of the most well known ways to send and receive money online, offering a convenient way to pay businesses and people. But while it’s a popular choice, it’s not always the best option for everyone. Fees, exchange rate markups, and account limitations can make it less ideal depending on your needs.

If you’re looking for something different, there are other payment providers operating in Ireland that offer competitive rates and features. In this roundup we’ll explore six of those options, including Wise, to help you find the best alternative to PayPal.

Wise: +40 currencies in

one account

PayPal is an international payment provider that offers solutions to business and personal customers through the PayPal account and PayPal Business account.¹ Looking at personal customers, here’s the highlights for how PayPal works in Ireland:

- Make online payments by without needing to manually enter your card details each time

- Use the PayPal QR code feature to pay in person

- Transfer money to and from other PayPal users in multiple currencies

- Accept payments easily through a PayPal.me link.

If PayPal isn’t quite doing it for you then there are alternatives out there. There are providers that offer similar or the same features as PayPal, such as enabling customers to send, receive and pay money out in multiple currencies, or make payments without having to input card details. Let's explore six of them:

- Wise

- Revolut

- GooglePay

- Remitly

- CurrencyFair (Irish)

- Skrill

Let’s examine each of these options in some detail, taking a look at who they are and the pros and cons of using them as a PayPal alternative if you are a personal client.

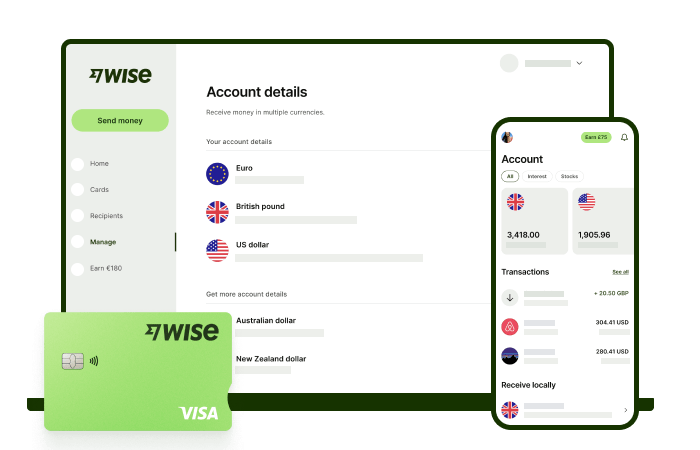

Founded with a mission to make managing money across borders simpler and cheaper, Wise is used by 12.8 million customers globally. Irish customers are serviced by our European Entity, Wise Europe SA, a payment institution authorised in Belgium.

Wise provides international payment services alongside a flexible multi-currency account, making it a strong alternative to PayPal for sending money abroad.

With Wise, you can send money abroad to +140 countries, either as a one-time transfer or through your Wise account.

As a personal customer, the Wise Account is free to open and maintain, allowing you to hold and convert 40+ currencies. Whenever there is currency conversion involved, Wise always uses the mid-market exchange rate (the same you normally see on Google), with a transparent fee.

Something useful that Wise offers is local account details for 8+ currencies including EUR, USD and GBP. This allows you to send and receive money like a local, including receiving payouts from online platforms like Amazon Affiliates UpWork.

| Wise Pros | Wise Cons |

|---|---|

Offering a suite of services to their personal customers, Revolut in Ireland offers a multi-currency account, travel benefits, and an investment platform. Unlike PayPal and Wise, theirs is a tiered service offering five plans²:

- Standard Plan - Free

- Plus Plan - €3.99 per month

- Premium Plan - €8.99 per month

- Metal Plan - €15.99 per month

- Ultra Plan - €45.00 per month

The plan determines what features users have access to and what the fees are and is possible to change between plans.

With Revolut you can send money to other Revolut users as well as supported bank accounts and cards. It’s also possible to generate Revolut.me payment links to request money from a card, or another Revolut user.

| Pros | Cons |

|---|---|

When it comes to the exchange rate Revolut makes up their own then adds an exchange fee when applicable. Whether this is a pro or con of using Revolut would depend on the rate you're getting and how it compares to other providers like Wise or PayPal.¹⁷

| Read more: Wise vs Revolut |

|---|

Created by internet services powerhouse Google, Google Pay is different to the last two options. Rather than being an account where you can store money, it connects to payment methods from other platforms and allows you to use those to make payments online and in person.⁶

Once you have the Google Pay app installed, payment cards like the Wise Card can be added to your Google Wallet which connects them to your Google account. When you want to pay in store, simply open the Google Pay app and use it to make a contactless payment by holding your device up to the card reader.

When shopping online, some retailers also allow you to check out with Google Pay. Similar to checking out with a PayPal account, you click “Buy with Google Pay” and your pre-saved card details will be used to complete the transaction.

| Pros | Cons |

|---|---|

Skrill is an online wallet that allows customers to send and spend money online.

Starting with their money transfer services, Skill supports sending in 40 different currencies.¹⁰ You can send money to a bank account or another Skrill user by inputting their name and email or phone number.

The online payment system is similar to PayPal’s in that you don’t need to enter your card details to pay at supported checkouts.¹¹ Instead when you see the Skrill logo at an online checkout you press that and follow the prompts to complete the one-click payment.

The platform is used by many gaming sites and trading platforms as well as some online stores.

| Pros | Cons |

|---|---|

If you mostly use PayPal to send money then Remitly is a possible alternative. It was created to be a simple way to send money to people you know, like family and friends. Their specialisation is sending money abroad.

When sending money with Remitly you get to choose how your recipient will get the money, which can include a bank deposit, cash pickup, digital wallet or home delivery.⁷ You also get to choose how to fund the transfer, with bank transfers, debit card, credit card and Apple Pay all being options.

Just like Wise for private clients, it’s free to open and maintain a Remitly account, you simply pay for what you use. Each time you make a transfer with Remitly the cost will vary depending on the currencies and countries involved, amount being sent, the payment method and chosen delivery option.⁸

| Pros | Cons |

|---|---|

Remitly’s exchange rate and fees are variable, based on what it costs Remitly to do the transaction.¹⁸ This cost varies depending on things like the currency, payment method and delivery choice. A positive for this kind of exchange rate is that you save when they do, but on the flip side it could make it trickier for you to know what to expect when you do make a transfer.

A homegrown provider, CurrencyFair launched in Ireland back in 2010 and focuses on cross-border payments and foreign currency exchange.

A CurrencyFair account is free to set up, you just pay for each transfer or currency exchange you make. It’s possible to store money in the account for a short time, but only if they’re attached to an exchange or transfer order.¹⁵

| Pros | Cons |

|---|---|

So which is the best alternative to PayPal? Well, that all comes down to you.

PayPal offers a wide range of services so when looking at alternatives it should come down to your specific needs. The best option is based on what you want to do with the account.

For example, Google Pay is handy for making payments without entering card details while Wise is a strong choice for managing money across borders.

Take stock of what you want and consider the pros, cons and fees of each to make the best decision for you.

Sources used:

Sources last checked on date: 3 March 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

This article is all about the safety of Wise card. Discover all the security measures you can add to your Wise account and card.

If you need to access the banking system in the USA, looking for Irish banks might be a possibility. Read this article to check your options.

Discover the complete guide to Irish banks operating in the UK. Check the services and alternatives for managing your money between Ireland and the UK.

If you want to know what kind of card the Wise card is, this article will explain everything.

Is it possible to buy Swiss francs online? Discover where you can do this and how much it costs.

What is the process to import a car from Northern Ireland? Discover in this guide.