We're changing our fees for sending USD outside the US from 18 June 2025. For new customers, the fees apply from the 18 of June 2025. For existing customers, new fees apply according to our customer notice period. Read about customer notice periods here.

The information on this page applies when you’re sending USD internationally and you want your recipient to receive USD (for example sending USD to a recipient in France and the payment staying in USD). It doesn’t cover transfers where USD is converted to another currency, or when you send USD domestically within the United States.

Wise fees for sending USD outside the US after 18 June 2025

Wise fees for sending USD outside the US

Our prices vary depending on what currency you’re sending from and how you pay for your transfer:

The currency you're sending from. If it's not USD, we’ll convert your money using the mid-market rate and charge a conversion fee and a flat Swift fee.

How you choose to pay for the transfer (for example: Wire, ACH or using your Wise balance). Using your Wise balance is the cheapest option.

Whether we predict you’ll be charged correspondent and beneficiary bank fees.

The Swift component of the fee will always be a fixed fee per transfer, irrespective of the amount you’re sending:

If we predict no additional correspondent and beneficiary bank fees based on our smart routing tool, we’ll charge you 7.41 USD.

If we predict correspondent and beneficiary bank fees, we’ll charge between 7.94–35 USD depending on the country you are sending to. The fee is higher as we’ll make sure to cover the correspondent fees with our fees, so your recipient will get the full amount.

The easiest way to see the exact pricing is to set up a transfer — we'll calculate everything for you and show you up front what you're paying.

Example for fees for sending USD outside the US

You’re sending USD to a business in China and want them to receive 4000 USD. You fund this transfer from your USD balance. If we predict no additional fees, your transfer will cost 8.54 USD (7.41 USD Swift payout fee + 1.13 USD Wise fee).

You’re sending USD to a business in China and want them to receive 4000 USD. You fund this transfer from your USD balance. If we predict correspondent fees, your transfer will cost 15.47 USD (14.34 USD Swift payout fee +1.13 USD Wise fee).

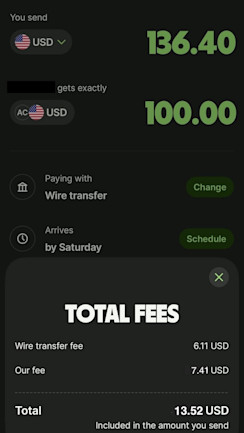

You’re sending USD to someone in Austria and want them to receive 100 USD. You fund this transfer using a USD Wire transfer. If we predict no additional fees, your transfer will cost 13.52 USD (7.41 USD Swift payout fee + 6.11 USD Wire transfer fee).

Swift fees for sending USD to recipients outside the US

The cost of sending USD to different destinations is not the same because the correspondent bank network varies by the country. If we predict correspondent bank fees, the price we give you will be based on the country you are sending to. This ensures you only pay for what you actually use. No more, no less.

If we predict you won’t be charged a hidden correspondent fee

| Recipient country | Swift fee per transfer* |

|---|---|

| All countries | 7.41 USD |

*This doesn’t include conversion fees, or the fees to cover how you’re paying for the transfer (for example card fees if you’re paying by card). We’ll always show the total fees for what you’re sending at the time you set up a transfer.

If we predict you'll be charged a hidden correspondent fee

You pay a little more to ensure that the recipient gets the full amount. If the country you are sending to isn't in the table below, the Swift fee for your transfer will be 21.71 USD. Check to which countries you can send USD via Swift.

| Recipient country | Swift fee per transfer* |

|---|---|

| Albania | 15.93 USD |

| Antigua and Barbuda | 24.07 USD |

| Argentina | 22.25 USD |

| Armenia | 18.87 USD |

| Australia | 13.10 USD |

| Austria | 26.00 USD |

| Bahamas | 16.05 USD |

| Belgium | 34.84 USD |

| Bolivia | 14.61 USD |

| Bosnia and Herzegovina | 24.32 USD |

| Botswana | 15.35 USD |

| Bulgaria | 35.00 USD |

| Cambodia | 7.94 USD |

| Canada | 12.38 USD |

| Chile | 21.73 USD |

| China | 14.34 USD |

| Costa Rica | 13.97 USD |

| Cyprus | 16.76 USD |

| Czech Republic | 23.36 USD |

| Denmark | 33.54 USD |

| Dominican Republic | 9.54 USD |

| Ecuador | 9.63 USD |

| El Salvador | 10.18 USD |

| Ethiopia | 17.41 USD |

| France | 27.29 USD |

| Georgia | 11.26 USD |

| Ghana | 15.52 USD |

| Guatemala | 9.98 USD |

| Honduras | 10.02 USD |

| Hungary | 22.80 USD |

| India | 22.21 USD |

| Indonesia | 35.00 USD |

| Ireland | 24.86 USD |

| Israel | 35.00 USD |

| Italy | 28.43 USD |

| Jamaica | 14.60 USD |

| Kazakhstan | 12.22 USD |

| Kenya | 19.53 USD |

| Kyrgyzstan | 23.76 USD |

| Lebanon | 15.81 USD |

| Macedonia | 20.54 USD |

| Malawi | 15.31 USD |

| Malaysia | 19.74 USD |

| Mauritius | 19.83 USD |

| Mexico | 15.69 USD |

| Mongolia | 34.89 USD |

| Montenegro | 15.17 USD |

| Morocco | 17.10 USD |

| Nepal | 16.37 USD |

| New Zealand | 22.61 USD |

| Nicaragua | 8.39 USD |

| Norway | 17.56 USD |

| Panama | 13.39 USD |

| Paraguay | 21.68 USD |

| Peru | 35.00 USD |

| Philippines | 10.40 USD |

| Poland | 32.62 USD |

| Portugal | 20.29 USD |

| Romania | 30.35 USD |

| Saint Lucia | 14.85 USD |

| Serbia | 19.96 USD |

| Singapore | 18.55 USD |

| Slovenia | 18.77 USD |

| South Africa | 18.57 USD |

| South Korea | 35.00 USD |

| Spain | 33.90 USD |

| Sri Lanka | 18.74 USD |

| Suriname | 15.24 USD |

| Sweden | 21.07 USD |

| Switzerland | 18.28 USD |

| Taiwan | 19.29 USD |

| Tanzania | 19.27 USD |

| Thailand | 35.00 USD |

| Timor-Leste | 15.00 USD |

| Tunisia | 35.00 USD |

| Turkey | 27.62 USD |

| Turks and Caicos Islands | 15.42 USD |

| Uganda | 14.67 USD |

| United Arab Emirates | 24.93 USD |

| United Kingdom | 22.26 USD |

| Uruguay | 26.28 USD |

| Uzbekistan | 18.07 USD |

| Vietnam | 10.23 USD |

| Zambia | 14.74 USD |

*This does not include conversion fees, and fees to cover how you’re paying for the transfer (for example card fees if you’re paying by card). We’ll always show the total fees for what you’re sending at the time you set up a transfer.

Sending USD to recipients in Hong Kong, Singapore or Ukraine?

To send USD outside the US, we mostly use the Swift network. However, if it’s going to a recipient in Hong Kong, Singapore (only if recipient has account with DBS), or Ukraine (only if recipient has account with Privatbank), we can pay out your money locally.

Read here for more about sending USD to Hong Kong, Singapore or Ukraine.

Wise fees for sending USD outside the US before 18 June 2025

For existing customers, new fees apply according to our customer notice period. Read about customer notice periods here.

Wise fees for sending USD outside the US

The easiest way to see the exact pricing is to set up a transfer — we'll calculate everything for you and show you up front what you're paying.

Our prices vary depending on what currency you’re sending from and how you pay for your transfer – for example Wire, ACH or your Wise balance.

If we predict you won’t be charged a correspondent fee, we’ll charge between 1-16 USD* depending on how you pay

If we predict you’ll be charged a correspondent fee, we’ll charge between 3-37 USD* depending on how you pay and where you're sending to

Check where you can send USD to.

*Note: some payment methods or currency conversions have percentage fees that may increase the fee. Check the tables below for detailed info.

If we predict you won’t be charged a correspondent fee

Based on how you send us the money and the currency it’s in, we’ll charge you the following:

| Currency and paying method | Swift Share* |

|---|---|

| USD wire | 17.41 USD |

| USD ACH | 11.30 USD + 0.28% |

| USD Wise balance | 12.43 USD |

| EUR bank transfer | 2.37 USD + 0.51% |

| GBP bank transfer | 2.08 USD + 0.38% |

| AUD bank transfer | 2.13 USD + 0.40% |

*Swift Share fees if we predict you won't be charged a correspondent fee

Example: you send 3,900 USD to China. You pay for this transfer with a USD Wire transfer. We then predict that you won’t be charged a correspondent fee, so the cost of your transfer will be 17.41 USD.

The fee would be different if you select ACH to pay for the transfer. If you used this method, the cost of your transfer would be 11.31 USD (11.30 USD + 0.28% * 3,900 USD = 22.22 USD).

If we predict you’ll be charged a correspondent fee

The fee we charge depends on the country you're sending money to.

If your recipient is in one of these countries:

Belgium, Bulgaria, Denmark, Germany, Indonesia, Israel, Japan, Netherlands, Poland, South Korea, Spain, Taiwan, Thailand, Turkey, United Arab Emirates, Uruguay, Vietnam.

Based on how you send us the money and the currency it’s in, we’ll charge you the following:

| Currency and payment method | Swift Share** |

|---|---|

| USD wire | 36.40 USD |

| USD ACH | 30.29 USD + 0.28% |

| USD Wise balance | 31.42 USD |

| EUR bank transfer | 21.36 USD + 0.51% |

| GBP bank transfer | 21.07 USD + 0.38% |

| AUD bank transfer | 21.12 USD + 0.40% |

**Swift Share fees if we predict you will be charged a correspondent fee

Example: you send 3,900 USD to Taiwan. You fund this with a GBP bank transfer. We then predict that you’ll be charged correspondent fees, so your transfer will cost 35.89 USD (21.07 USD + 0.38% * 3900 USD = 35.89 USD).

If your recipient is in Hong Kong

Based on how you send us the money and the currency it’s in, we’ll charge you the following:

| Currency and payment method | USD Swift Payout to a recipient in Hong Kong |

|---|---|

| USD wire | 19.38 USD |

| USD ACH | 13.27 USD + 0.28% |

| USD Wise balance | 14.40 USD |

| EUR bank transfer | 4.34 USD + 0.51% |

| GBP bank transfer | 4.05 USD + 0.38% |

| AUD bank transfer | 4.1 USD + 0.40% |

Example: you send 3,900 USD to Hong Kong and you fund it with an AUD bank transfer. It will cost 19.7 USD (4.10 USD + 0.40% * 3,900 USD = 19.7 USD).

If your recipient is in Singapore

The fee depends on where they bank, as well as on how you send us the money and the currency it’s in.

| Currency and payment method | USD Swift Payout to recipient in Singapore with DBS account |

|---|---|

| USD wire | 16.68 USD |

| USD ACH | 10.57 USD + 0.28% |

| USD Wise balance | 11.70 USD |

| EUR bank transfer | 1.64 USD + 0.51% |

| GBP bank transfer | 1.35 USD + 0.38% |

| AUD bank transfer | 1.4 USD + 0.40% |

Example: you send 2,000 USD to Singapore and they have an account with DBS. You fund this with a USD ACH transfer. It'll cost 16.17 USD (10.57 USD + 0.28% *2,000 USD = 16.17 USD).

If your recipient is in Ukraine

The fees depend on whether the recipient has a PrivatBank account. Check the two tables below to compare.

With PrivatBank account

| Currency and payment method | USD Swift Payout to recipient in Ukraine with PrivatBank |

|---|---|

| USD wire | 16.68 USD + 1.28% |

| USD ACH | 10.57 USD + 1.56% |

| USD Wise balance | 11.70 USD + 1.28% |

| EUR bank transfer | 1.64 USD + 1.79% |

| GBP bank transfer | 0.35 USD + 1.66% |

| AUD bank transfer | 0.4 USD + 1.68% |

Without PrivatBank account

| Currency and payment method | USD Swift Payout to recipient in Ukraine without PrivatBank |

|---|---|

| USD wire | 36.40 USD |

| USD ACH | 30.29 USD + 0.28% |

| USD Wise balance | 31.42 USD |

| EUR bank transfer | 21.36 USD + 0.51% |

| GBP bank transfer | 21.07 USD + 0.38% |

| AUD bank transfer | 21.12 USD + 0.40% |

Example: you send 1,000 USD to Ukraine and the recipient account is with PrivatBank. If your funding method is Bank Transfer and your funding currency is EUR, it'll cost 19.54 USD ( 1.64 USD + 1.79% * 1,000 USD = 19.54 USD).

If your recipient is in any other country

We'll charge the following fees, based on how you send us the money and the currency it’s in. See exceptions below and read more about it here.

| Currency and payment method | USD Swift Payout to a recipient in any other country |

|---|---|

| USD wire | 23.93 USD |

| USD ACH | 17.82 USD + 0.28% |

| USD Wise balance | 18.95 USD |

| EUR bank transfer | 8.89 USD + 0.51% |

| GBP bank transfer | 8.6 USD + 0.38% |

| AUD bank transfer | 8.65 USD + 0.40% |

Example: you send 3,900 USD to China . You fund this with a EUR bank transfer. We then predict that you’ll be charged a correspondent fee, so the cost of your transfer is 28.78 USD (8.89 USD + 0.51% * 3,900 USD = 28.78 USD).

What about FFC payments?

We can’t send For Further Credit (FFC) payments. FFC is a payment made to a beneficiary that is not final. This means you can't send money to a recipient who will then forward the money somewhere else. These transactions require a separate field for entering the actual final recipient, and we don't have that option.

How does Swift work?

When sending international payments in currencies that aren't local to the destination country, such as sending USD outside the US or euros outside of Europe, your money travels via the Swift network.

Sending money via the Swift network is like travelling from one airport to another — it’s not always possible to take a direct flight, so you may need to travel from city to city via several connecting flights.

Swift works the same way. The money will travel from one country to another through correspondent banks. These correspondent banks often charge their own fees.

Wise can’t influence the fees charged by the correspondent banks, however, we’ve built a smart-routing tool based on the their historical fees and speed. If it predicts there won’t be any hidden fees from correspondent or beneficiary banks, your Swift payment will be cheaper as we don't need to add these fees upfront.

If it predicts additional fees, they’ll be included upfront. This means your payment might be more expensive, but your recipient will receive the full amount you intended to send.