Importing from Spain to the UK: Complete Business Guide

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

If your business has a branch or subsidiary in Saudi Arabia, you’ll need to know about ZATCA e-invoicing.

The country has new rules which make it mandatory for B2B businesses to issue invoices electronically. Electronic invoices are digital versions of paper invoices, and are usually issued and processed using automated digital tools.

In this helpful guide, we’ll run through everything you need to know about ZATCA e-invoicing software, rules and regulations.

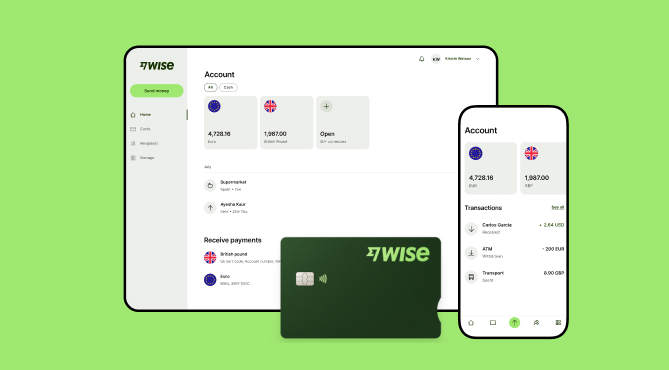

And if you need a cost-effective and fast way to get paid by your overseas clients in Saudi Arabia or worldwide, take a look at the Wise Business account.

With this powerful online account, you can receive international payments in multiple currencies, without the complexities or costs of using a bank.

💡 Learn more about Wise Business

ZATCA stands for the Zakat, Tax and Customs Authority, which is the official tax authority in Saudi Arabia. It’s the equivalent of HMRC in the UK.

In December 2021, ZATCA introduced Phase 1 of the FATOORAH e-invoicing project. It brought in new rules making electronic invoicing mandatory for all resident taxpayers, and applies to all B2B and B2C transactions in the country.

During Phase 1, taxpayers were told to stop issuing manual and handwritten invoices. These will no longer be legally accepted in Saudi Arabia. Instead, they were required to adopt an electronic invoicing solution which complied with ZATCA requirements.

Phase 2 of the project got underway in January 2023. This involved phased compliance, where companies meeting certain revenue thresholds were informed that they’d need to connect to the ZATCA system within 6 months.

If companies fail to comply with the regulations, penalties of up to 50,000 SAR may apply.²

Importantly, the FATOORAH e-invoicing project only affects resident individuals and companies within Saudi Arabia. Non-resident businesses will not have to use compliant e-invoicing solutions.¹

So if you’re a UK-based company with Saudi Arabian clients, you can invoice as normal - or reach an agreement with your client on how to proceed with billing and invoicing.

However, if you are a UK company with branches or subsidiaries in Saudi Arabia, the ZATCA rules may apply to you. If unsure, contact the authority to find out more about your obligations with regards to e-invoicing.

If you do need to comply with ZATCA e-invoicing rules, here are the main rules and key points you need to know about:¹

- ZATCA will give you a Phase 2 compliance deadline - you’ll be notified of this at least six months in advance. This should give you adequate time to bring your invoicing system into compliance

- By your compliance deadline, you need to integrate your e-invoicing system with the FATOORAH platform and meet all ZATCA rules and requirements

- Before this, you need to switch from paper invoices to ZATCA e-invoicing software - or at least make sure you use software that includes the mandatory fields. These include VAT number, invoice issuance date and the VAT. An optional QR code can be added

- Phase 2 requirements include the ability to generate and store e-invoices in the XML or PDF format, with the required mandatory fields

- It’s also essential that your e-invoicing system or solution can connect to the internet

If you’re new to e-invoicing or to doing business in Saudi Arabia, you’re bound to have questions. To help make it a little easier, we’ve tackled some of the most frequently asked questions about ZATCA e-invoicing below.

Yes, electronic invoicing became mandatory for all B2B and B2C transactions from December 2012. The Zakat, Tax and Customs Authority (ZATCA) is managing compliance in phases, to give businesses and organisations time to update their invoicing systems and integrate them with the FATOORAH platform.

By June 1st 2024, most businesses in Saudi Arabia will be legally obliged to comply with the ZATCA e-invoicing system.¹

Phase 1 of the FATOORAH e-invoicing project in Saudi Arabia is known as the generation phase. It’s essentially a notification to all taxpayers and businesses that manual, paper and hand-written invoices are no longer accepted in the country - and that they must switch to an e-invoicing solution.

Phase 2 of the project aims to gradually bring businesses into compliance, with staged compliance deadlines based on annual revenue. During this phase, businesses will need to ensure their e-invoicing solutions integrate with the FATOORAH platform.

An e-invoice is a digital version of an invoice document, which is submitted and processed electronically. A normal invoice is usually in paper form, and requires manual processing and filing.

Wise Business can help your company get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

And that’s it - all the essentials you need to know about the ZATCA e-invoicing rules and requirements. We’ve run through what the FATOORAH e-invoicing project is, who it affects and the key deadline dates to ensure compliance.

If you’re a UK business with a branch or subsidiary in Saudi Arabia, this information really is crucial for you. It’s important to understand your obligations and get your electronic invoicing system up to date and compliant with ZATCA rules.

If you only trade with Saudi Arabia and you’re based in the UK, you don’t have to take any specific action but it’s useful to know about the FATOORAH e-invoicing project all the same. In the future, it may be updated to include international businesses which trade with Saudi Arabian clients.

Sources used for this article:

Sources checked on 30-04-2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

Read our complete business guide on importing from Türkiye to the UK, covering everything from customs to shipping methods.

Is Tide Bank safe? Find out everything you need to know about Tide Bank business account security here.

Is Revolut Business safe? Find out everything you need to know about Revolut UK security here in our helpful guide.

Read our helpful guide on how to start a business in Romania from the UK, including info on company formation, legal entity types and required documents.

Read our helpful guide on how to start a business in Lithuania from the UK, including info on Lithuania company formation, legal entity types and more.