Orange Money international money transfer guide [2024]

Everything you need to know about sending money abroad with Orange.

Looking to send an international payment from the US? There are lots of ways to do it, but some are better than others.

You could wire money using your bank, but an online money transfer specialist could be both cheaper and faster.

In this guide, we’ll be looking at two big names in the money transfer world - Western Union vs. Ria Money Transfer. Both are US-based, but how do they compare on fees and exchange rates?

We’ll also throw an alternative into the mix - Wise. With low fees and great exchange rates, it could work out cheaper than some providers, especially compared to using your bank.

Before we dive into which provider is cheaper in the US, it’s worth knowing a little background about each company.

Western Union (WU) is an international transfer specialist based in the United States. The company has a long history dating back to 1861, when it was founded as the Western Union Telegraph Company.¹

Today, it offers:

WU also used to offer business solutions, before being acquired by another company.

Find out more about how to use Western Union in our handy guide.

Also based in the US, Ria Money Transfer is a younger business, although it has been operating since 1987.² Owned by Euronet Worldwide Inc, the company has:

| 💡 Read our Ria Money Transfer review for the full lowdown on the transfer provider. |

|---|

Now we come to that all-important question - how much does it cost to use Western Union and Ria? And which is the cheaper option?

Let’s take a look at what each provider charges in upfront transfer fees.

Western Union’s fees vary depending on the details of the transfer. This includes the destination, amount, currency, payment and delivery methods.

The great news is that many transfers are fee-free, especially when you pay with a debit card or bank account. The only thing to watch out for is paying with a credit card, as there’s a fee of around $25. Fees also apply when you pay for your transfer in person at a store.³

| 💡You can check the fee for your transfer in advance over on the Western Union website, using the price estimator tool. Or you can use the WU app. |

|---|

Just like Western Union, Ria’s upfront transfer fees also vary based on factors like the currency, destination, payment and delivery methods.

You can check the fee in advance on the Ria home page, before sending your transfer. You’ll need to enter the amount you want to send and the destination country, and you’ll be able to see the fee, live exchange rate and how much the recipient will get after currency conversion.

Ria Money Transfer also offers promotions from time to time, depending on where you’re based. This includes a free initial transfer when you sign up as a new customer.

As well as checking out the fees, it’s also a smart idea to compare Western Union vs. Ria on rates for converting currency.

The exchange rate can make a huge difference to the overall cost of sending money abroad. This is because it affects how much of your money actually reaches your recipient, and how much is lost in currency conversion.

Some transfer providers add their own margin or mark-up to what is known as the mid-market or interbank rate. This is considered to be one of the fairest rates you can get.

By adding in a mark-up, this is how some banks and transfer providers make their money. But unfortunately, it makes the transaction a little more expensive for you.

Both Western Union and Ria Money Transfer are likely to add a margin to the mid-market rate. We’ll show you how this could affect your transfer next.

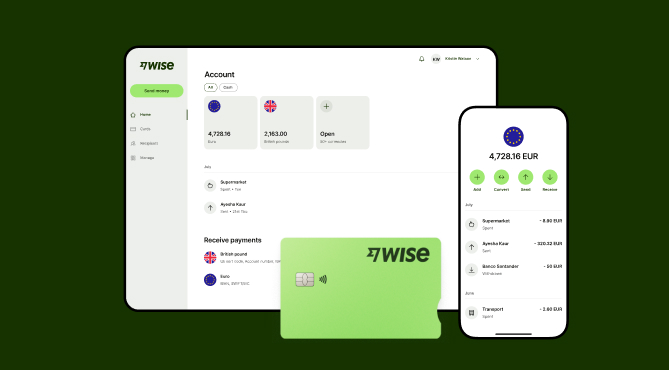

For a winning combination of low fees and margin-free exchange rates, use Wise to send money internationally.

Open a Wise account online and you’ll get all these fantastic benefits:

It’s quick, easy and free to open a Wise account online. And there’s even a handy Wise app, so you can manage everything from your phone. This includes sending and tracking transfers, and checking in on money you’ve received from senders all over the world.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

The fees and rates to send money abroad can vary quite a bit depending on the details of a given transfer. So to help you get a true picture of how much it costs with Western Union and Ria Money Transfer, let’s do a quick example.

Imagine you want to send $1,000 to a friend in Germany (EUR). Below is how much your recipient will receive with Western Union, Ria and an alternative such as Wise - with both fees and exchange rates taken into account.

For the sake of this example, we’ve done a bank-to-bank transfer, and assumed you’re a new customer (this means you can take advantage of the new customer offer at Ria Money Transfer)

| Provider | Transfer fee | Exchange rate | Recipient receives |

|---|---|---|---|

| Western Union³ | $0 USD | 0.9031 | €903.10 EUR |

| Ria Money Transfer⁴ | $0 (first transfer only, $5 fee after) | 0.90 | €904.50 EUR |

| Wise⁵ | $6.82 USD | 0.920450 - mid-market rate | €914.17 EUR |

Correct at time of researching - 22-Aug-2023 – Pay-in method used for the transfer is ACH.

As you can see from this table, it’s the exchange rate that makes all the difference with international transfers.

Even though providers like Western Union and Ria charge no fees for some transfers, Wise still comes out on top because of its better exchange rate.

This is why it always pays to look closely at the exchange rate and compare a range of alternatives before hitting ‘send’ on that transfer.

Wise offers fast, secure and convenient transfers worldwide, along with a powerful multi-currency account and international debit card.

Check out how much it’ll cost to send your transfer with Wise here.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

After reading this, you should have a better idea of what fees and exchange rates to expect with Western Union and Ria Money Transfer. We’ve even looked at a hypothetical example, so you can see these costs in action.

But which provider is cheaper will all come down to your particular transfer. You’ll need to compare the fee and rate for both WU and Ria when the time comes, to see which is the best value.

And don’t forget to include Wise in your comparison. You could save money by sending international transfers with Wise, benefiting from low fees and great exchange rates.

It all comes down to the details of your particular transfer, especially if cost is your primary focus.

The fees for sending transfers with either service can vary depending on the amount, currency and other factors. So, you’ll need to compare the two, remembering to look at the exchange rate as well as the fees.

Yes, Ria Money Transfer is a completely separate company from Western Union, even though they both offer online money transfer services.

No, Ria Money Transfer isn’t owned by Western Union. The company that owns it is Euronet Worldwide Inc, an American provider of global electronic payment services.

Of course, Ria and Western Union aren’t the only money transfer companies out there. You should also compare prices with other providers, such as MoneyGram, to see which is cheaper.

| 💡Take a look at our guide to alternatives to Western Union, including a look at Ria vs. MoneyGram vs. Western Union. |

|---|

Sources used:

Sources last checked on date: 22-Aug-2023 >/small>

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about sending money abroad with Orange.

What is Ria and how does it work?

Your full guide to international Amscot wire transfers.

Your full guide to M-Pesa international transfers.

Your complete guide to Pangea Money Transfer safety

Your guide to understanding and avoiding wire transfer scams