How to Change PayPal from Personal to Business: Easy Guide

Learn how to easily upgrade your PayPal account from personal to business with our step-by-step guide. Unlock advanced features and benefits tailored for your b

Cash flow analysis is an integral part of financial reporting.

Regular monitoring and analysis of cash flow can ensure that businesses are operating in the most fiscally prudent way, and can plan growth and expansion more strategically.

It also makes overall finance management a much easier process.

This article will look at what is cash flow analysis, why cash flow analysis is important for international businesses, and how to analyse cash flow to help make the process as easy as possible for you.

| This article will cover: |

|---|

Before diving into cash flow analysis, let’s take a step back to talk about what cash flow is first.

In the easiest of terms, cash flow refers to the inflow and outflow of cash and cash equivalents in a business. Cash flow analysis looks at that inflow and outflow in more detail to understand where and how cash is present in your business.

Examples of cash inflow include: collecting payments from customers across the world when purchasing products and services, and cash coming in from investments.

Examples of cash outflow include: paying salaries overseas, purchasing inventory and storage space in multiple countries, and office rent across locations.

Cash flow can be analysed with the help of a cash flow statement¹ and is used to identify opportunities to optimize cash flow accordingly.

Analyzing the cash flow statement is a way, to better understand and control the business finances and gain better insight into financial performance.

Analyse your cash flow easily,

With the free Wise template

As you might have gathered, cash flow analysis is extremely important for businesses.

With cash flow analysis, business owners can better control financial performance, such as reconsidering operating costs, understanding the impact of debt, and where a business could potentially grow.

For global businesses in particular, cash flow analysis plays a significant role. As your business expands across locations, responsibilities multiply.

International businesses have to take into account a variety of factors such as:

Regular monitoring and management of cash flow can help reduce the impact of these factors, alongside using the right financial tools.

| Manage your currencies and cash flow across countries with the most international account. Get a Wise Business account to make cash flow analysis easier. |

|---|

Discover the business features of Wise

Using cash flow analysis, businesses can decide what's the best next step for the company.

Rethink inflow and outflow

For example, if costly loan payments are impacting cash outflow, businesses can come up with a strategic approach to raise inflow by cutting down on operations or increasing investment activities to build new revenue streams.²

Understand the fiscal impact in multiple countries

As another example, international businesses can use cash flow analysis to understand the fiscal impact of operating in multiple countries and develop strategies to expand the business.

Identify market opportunities

Understanding cash flow and its impact in different locations can help businesses in deciding whether to expand into new markets, invest into strengthening their position in current markets or withdraw completely from countries where cash flow is low.

Prevent cash flow problems

Cash flow analysis is also helpful as a predictive measure. Understanding inflow and outflow across different time points can spot issues and precursors of financial distress such as bankruptcy.

Regular analysis and management can help prevent cash flow problems from becoming immense and ensure that a business is operating in a profitable way.

If you are not sure how to analyse your cash flow, the first step is to prepare a cash flow statement.

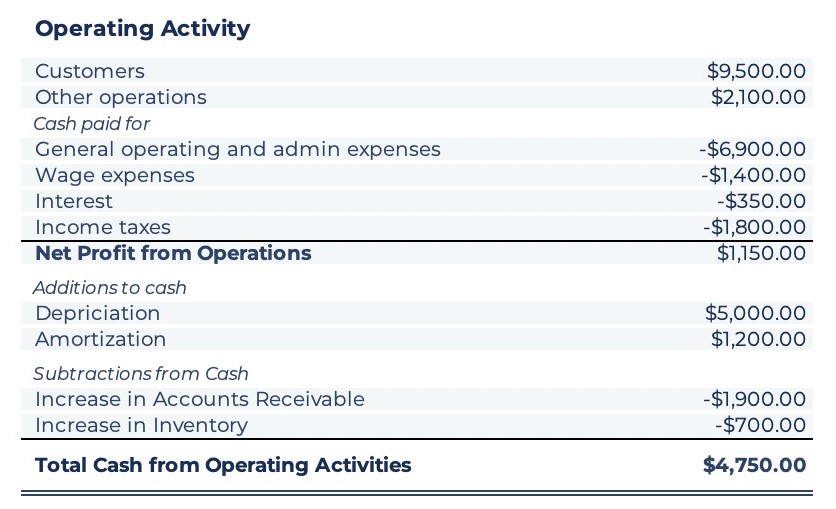

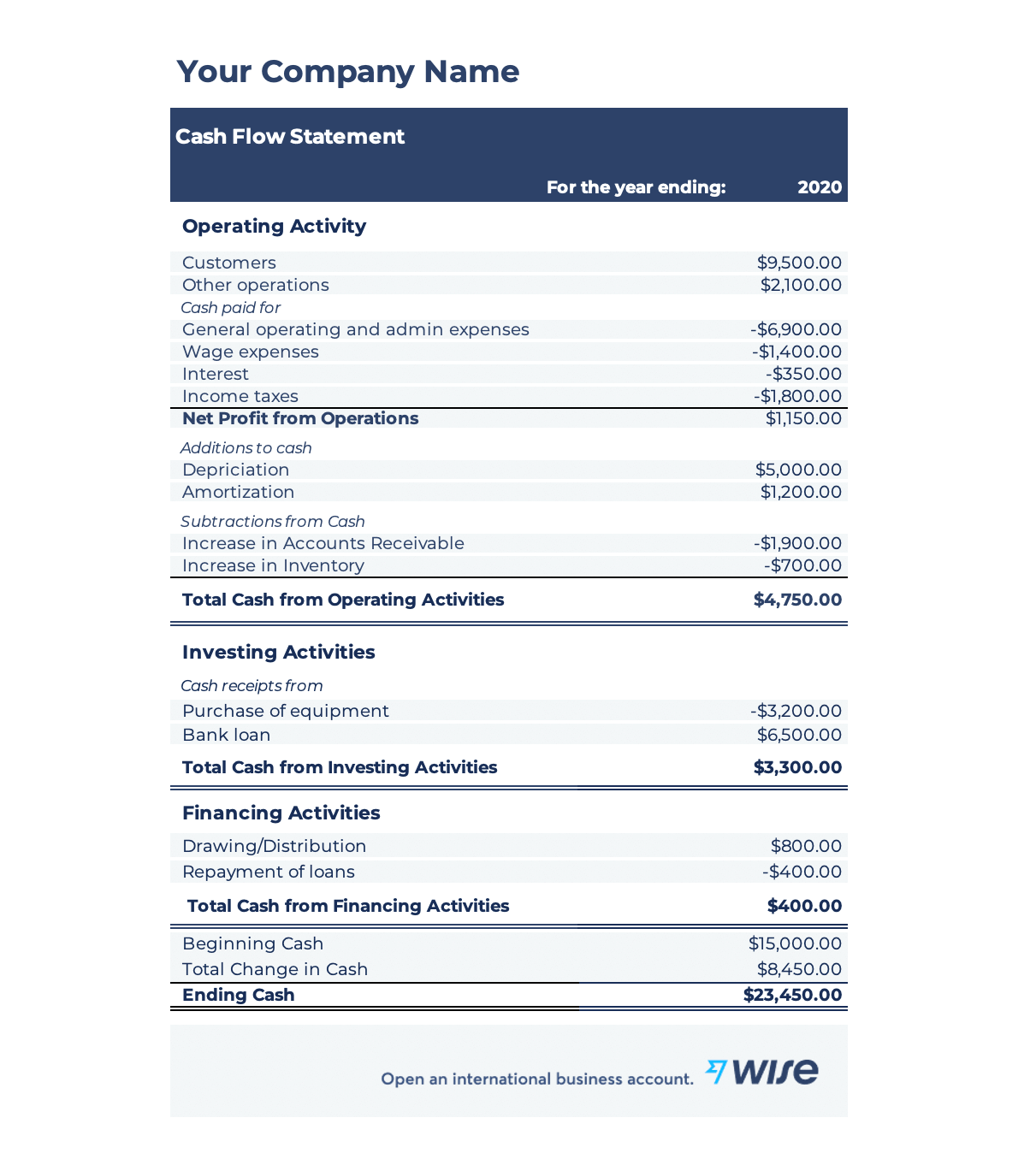

In the cash flow statement, you’ll see three different types of cash flow: operating, investing, and financing.

| Cash flow type | Definition |

|---|---|

| Operating cash flow | Refers to cash inflow and outflow generated through normal business operations. Operating cash flow occurs every day |

| Investing cash flow | Refers to cash inflow and outflow generated through investment activities the business undertakes. Investing cash flow occurs occasionally |

| Financing cash flow | Refers to cash and inflow generated from activities such as issuing and repaying debts and stocks. Financing cash flow doesn’t occur as often |

1. Analyse cash flow from operations

Once you enter operating costs, you can begin to see how much cash your business needs to operate as normal.

This can include:

2. Analyse cash flow from Investments

Understanding where your business has made investments can help you strategically allocate resources.

Cash flow from investments can include:

3. Analyse cash flow from financing

Generally, cash flow from financing is not as frequent as the others, but it can provide valuable insight on assets and liabilities.

Cash flow from financing can include:

A cash flow analysis is one part of the puzzle to understand the overall health of a business. Cash inflow and outflow can indicate many opportunities based on the cash flow type.

For example, high operating cash inflow is a satisfactory sign, as it means that your business is operating well - especially in the case of an international business where you sell products or services across different countries.

On the flip side, a high cash inflow could also indicate a loan that may prove difficult to pay back later if operating cash inflow is not increased in time.

Free cash flow refers to cash left after subtracting operating expenses and capital expenditures in some respects.

Free cash flow is a useful metric to understand how much money a business has to invest in its own growth, pay out dividends and repay debts as needed after accounting for its expenses.

| 💡 Cash flow analysis is usually undertaken to understand where businesses are in relation to free cash flow and how they can optimise strategies to reach free cash flow faster - a key for healthy businesses looking to grow and expand. |

|---|

It's important to note that free cash flow is just one metric, and it’s crucial to look at a variety of financial indicators to understand how well a company is performing.

For example, low free cash flow does not necessarily mean that the business is facing a crisis, as it could mean that the business used excess cash to pay back debts.

Similarly, high free cash flow is not always a good indicator, as it may show that the business owner is neglecting to invest in the business.

That’s why cash flow is one aspect of a comprehensive financial performance assessment.

But it’s equally just as important to ensure that cash flow is looked at alongside other metrics.

If you’re not sure how to do a cash flow analysis, you can use the Wise cash flow statement template to get started.

Get your free cash flow statement now

Let's look at an example below.

Take an example of a new clothing business that has recently started in the United States.

As you can see in the example, operating cash flow has increased for the business over the year, as more customers have made purchases.

However, as customers have purchased more, the business had to invest in itself by hiring employees, shoring up inventory, and purchasing more equipment as new employees are onboarded.

Some employees work from the United Kingdom and Belgium, therefore currency exchange fees need to be included - and that takes up more cash.

The business also applied for a loan to increase short-term cash flow for these activities. Both the loan amount and its payments are being factored into the analysis as well as other financing activities the business has.

To keep all costs at the minimum when multi-currency payments are involved, the business has to pay extra attention to exchange rates.

This is where Wise comes in the picture.

Wise offers a financial solutions to have better insight and control over your cash flow and business costs.

Offering a cheap way to send money and get paid from abroad, while saving up to 19x compared to PayPal, Wise gives you the chance to spend your money on things other than fees.

Initiate payments in one click, easily. Pay employees, invoices, and manage subscriptions around the world - all from one account.

Plus, you’ll always pay what you see with Wise. The fees are transparent and upfront —every time. You’ll always get the mid-market rate, so you can set up and receive payments with the exchange rate you see on Google.

Open a Wise business account today

Sources:All sources checked 09 September 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to easily upgrade your PayPal account from personal to business with our step-by-step guide. Unlock advanced features and benefits tailored for your b

This First Citizens Business Bank review will cover all you need to decide if it's the best choice for your business!

Explore the differences between Stripe and traditional merchant accounts in our in-depth analysis.

This guide to employee benefits in Sweden will cover all you need to stay compliant and provide the best additional benefits to attract talent.

Oxygen Business Account review will cover all you need to decide if it's the best choice for your business!

Navigating the intricate legal terrain of international royalties can be daunting for musicians, often leading to earnings sitting unclaimed. In fact, the...