CFPB warns providers to stop junk fees on international money transfers

So, will “fee-free” and “no fee” advertising disappear tomorrow?

Sending money abroad is a big deal for many Brazilians living international lives. You might be supporting your family, planning your next adventure, or expanding your business. But did you know that most people are unaware of what they're actually paying to send, spend, or receive money internationally?

Providers often advertise "$0 fee" or "free" transfers, but then set their own inflated exchange rates and pocket the difference between their rate and the mid-market rate, the one you see on Google.

$228 billion. That’s how much consumers and businesses lost in hidden fees in a single year around the world*.

In 2022, Brazil introduced new laws ("VET") mandating fee disclosure for foreign transactions. However, the law does not specify the exchange rate to be used, enabling providers to hide mark-ups by using their preferred rates. This maintains inflated exchange rates and discourages competition to reduce remittance costs. The Central Bank of Brazil has the authority to clarify the VET law and demand transparent disclosure of all fees, including any exchange rate mark-ups, to consumers.

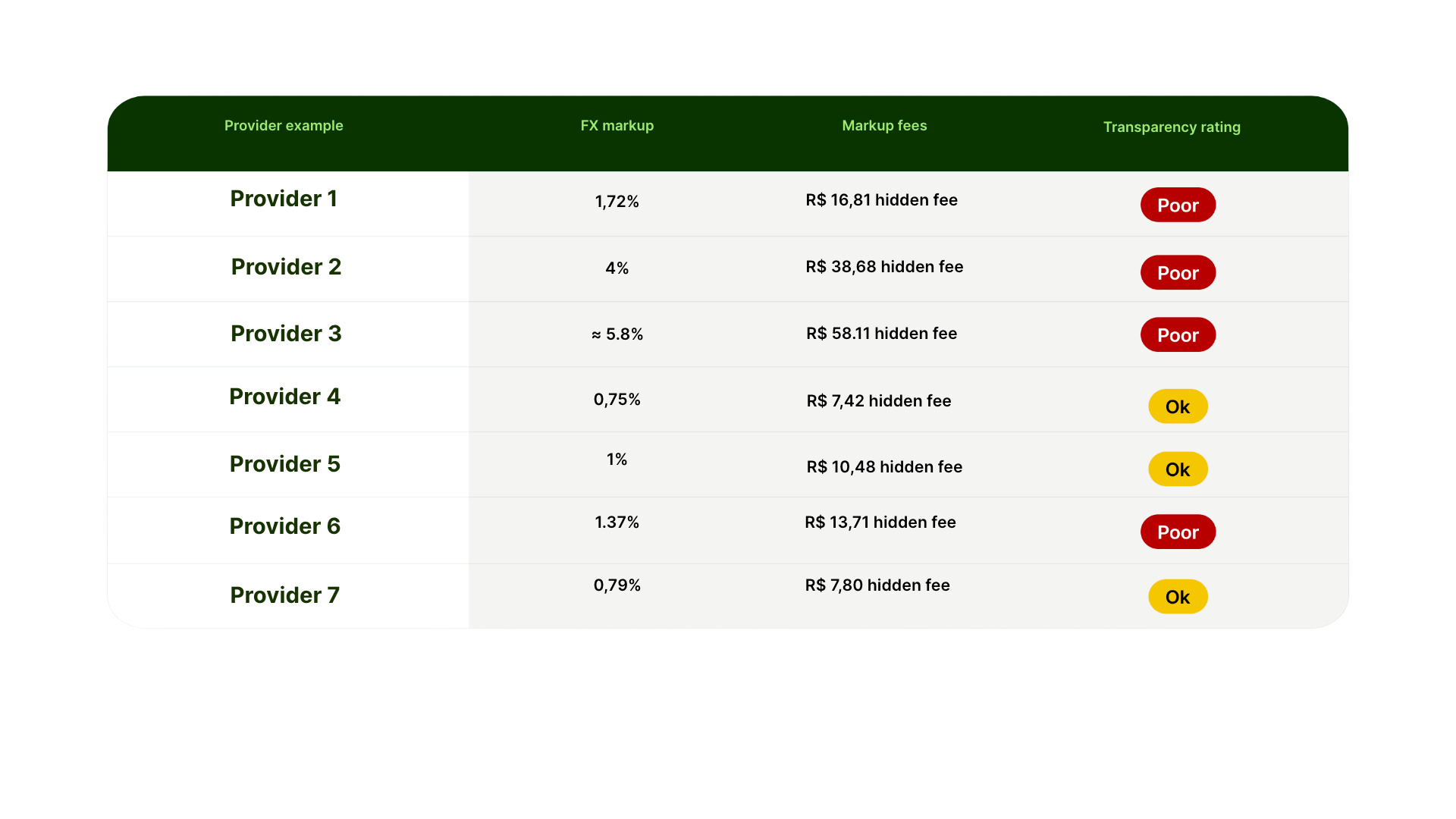

We looked at the state of transparency of different Brazilian providers, checking to see if they hide fees in exchange rate mark-ups. All of the providers we checked are not fully transparent. Brazil can be a rulemaker when it comes to transparency in remittances. Brazil’s diaspora is large, with 4.4 million Brazilians living abroad; increased price transparency would have a positive impact on those on either end of the payment chain.

Read the report to learn more about the state of transparency in Brazil

“One of the most important factors leading to high remittance prices is a lack of transparency in the market.” - The World Bank

Remittances are a lifeline to hundreds of millions of people around the world. The United Nations Sustainable Development Goal 10c aims to reduce the cost of remittances to less than 3% by 2030. The cost of sending remittances from Brazil is 7.61%, the second most expensive G20 sending country. This is why it's important to call on the Central Bank of Brazil to improve remittance price transparency in order to help reduce the cost of sending remittances and to help achieve the UN Sustainable Development Goal. Transparency is the only way that will enable people to compare costs, find better deals and put downwards pressure on prices.

At Wise, we believe in making finance fairer and ending hidden fees. Unlike banks and other providers, we tell you exactly the cost of your payments—no hidden fees, no unpleasant surprises—and offer fair, mid-market exchange rates for converting your money. Whether you're sending money to support your family, planning an exciting adventure, or growing your business, choose Wise. We prioritise transparency and have nothing to hide.

*Research commissioned by Wise and independently conducted by Edgar, Dunn and Company in 2021**Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

So, will “fee-free” and “no fee” advertising disappear tomorrow?

“Junk fees” were certainly a buzz word of 2023, as the Biden Administration announced a crackdown across industries to protect American consumers. The White...

In a year, US military service members spent more than $455 million on foreign exchange fees. Of that, $301 million was lost in hidden fees.

Wise was founded by immigrants, built by immigrants, and is used by immigrants.

£187 billion! That’s how much people and businesses lost to hidden fees in a single year.

We are here to protect your privacy and are always striving to ensure we remain transparent on how we handle your personal data. We have simplified the layout...