Moving from Ireland to the UK: Everything you need to know

Thinking of moving to the UK from Ireland? Check this comprehensive guide on how to go about it.

Whether it’s for family, work or new opportunities, you might be considering a move across the border from Ireland to Northern Ireland. While it’s easy enough to get there for a visit, moving your whole life can be a different story.

In this guide we’re going to walk you through some of the main considerations when moving to Northern Ireland, including your right to residence, the healthcare system and cost of living.

We’ll also look at the differences in currency and how the Wise Account might be able to help you manage your EUR and GBP balances in a simple and cost effective way.

Manage Euros and Pounds

in your Wise Account 🌏

- Northern Ireland population: 1.9 million⁶

- Capital: Belfast

- Currency: Pound sterling (£)

- Official languages: English, Irish⁷

- Number of Irish expats: Approximately 600,000 Irish passport holders⁹

- Biggest cities: Belfast, Derry, Armagh, Newry, Lisburn, Bangor⁸

To keep it short and sweet, Irish citizens don't need to worry about getting a visa when moving to Northern Ireland from Ireland.¹ We’ll go into why that is in just a second.

Despite all that went on with Brexit, an Irish citizen can move to Northern Ireland without too much hassle. This is because in 2019 the United Kingdom (UK) and Irish governments signed a Memorandum of Understanding which laid out a series of reciprocal rights and privileges for citizens of the two countries.¹

In the agreement it protects the right for Irish citizens to take up residence anywhere in the UK and work without the need to seek permission. In practical terms this means you don’t need to apply for a visa to live or work in Northern Ireland.

When deciding to move to a new country the cost of living can play a big part in making the decision. To give you a better understanding of the difference between Ireland and Northern Ireland, here’s a comparison of some everyday expenses and what they’ll set you back in Dublin compared to Belfast.²

Cost of living Ireland vs Northern Ireland

| Expense | Dublin | Belfast |

|---|---|---|

| Meal at an inexpensive restaurant | €20.00 | €17.98 |

| Pint of domestic beer | €6.08 | €6.03 |

| Milk (gal) | €4.90 | €4.69 |

| Chicken fillets (lb) | €4.46 | €3.06 |

| Fitness club membership (1 month) | €45.07 | €39.05 |

| Internet (1 month) | €52.93 | €41.49 |

| Rent (1 bedroom apartment/city) | €1937.29 | €997.77 |

As you can see the average cost of these items is lower in Belfast than Dublin. While this might mean the cost of living is less, you’ll also want to take a look at what jobs you can get in Northern Ireland and how the pay compares to what you’re currently earning in Ireland.

To work in Northern Ireland you don’t need a permit or visa so it’s generally a matter of finding jobs you’re qualified for and going through the application process.

Some sectors may require you to register with a local authority or have your qualifications verified, for example medical or education professionals.

The easiest place to start is generally an online job board. Here’s a few that are popular in Northern Ireland so you can start your search:

You could also try looking for a board that is dedicated to your sector, for example the Health and Social Care job board.

One of the bigger differences between Northern Ireland and Ireland is the currency; one uses British pounds while the other uses the Euro. When you move to Northern Ireland you'll need some form of account that will be able to accept, store and send GBP.

To open a bank account in Northern Ireland, you’ll generally need to complete an application form, show a valid form of personal identification and provide proof of a UK address, which can be tricky before you’ve settled.

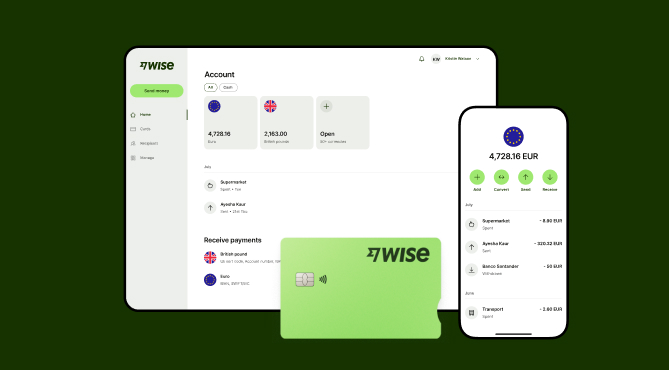

As an alternative, consider the Wise Account, which you can open while in Ireland and will be able to get local account details in pounds before moving.

Wise is an international money transfer specialist that offers personal and business accounts in Ireland.

With a personal Wise Accountyou can hold and convert over 40 currencies and get local account details for 9+ of those, including GBP and EUR. So it means you can have both currencies in one account and also receive money like a local.

You'll be able to do currency conversions at the mid market exchange rate (the one you see on Google) with no hidden fees or markups, which is hugely beneficial if you need to convert funds back and forth between EUR and GBP.

With a Wise Account you can also order a Wise debit card which makes daily spending in different currencies easy. Whenever you spend money it will automatically detect the currency and pull funds from that balance first, before converting whatever else is needed from an available foreign currency balance.

Opening a Wise Account it's free and getting a debit card costs a one-time fee of 7 EUR.

Open your Wise Account

today 🚀

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

In Northern Ireland, government health and social services care are provided by Health and Social Care. This group is often referred to as the HSC.¹⁰ It’s run by a number of different bodies which answer to the Northern Ireland Department of Health. For a bit of context, the equivalent to the HSC in the rest of the UK is the National Health Service (NHS).

Some people in Northern Ireland also choose to purchase private health insurance and use private hospitals, clinics, doctors and treatment centers.¹¹ This is usually done by individuals who want specialist or non-essential treatment, for example non-emergent diagnostic tests, cosmetic surgery or surgery in a private hospital.

Going back to the Memorium of Understanding we mentioned earlier, there’s also rights relating to healthcare in there. Under the agreement, Irish citizens residing in the UK have the same access to emergency, routine and planned public healthcare services as UK citizens.¹

When seeking healthcare in Northern Ireland, what needs to be paid, reimbursed or is free will depend on the type of treatment you’re seeking and whether you’ve chosen to go public or private.

The process for renting a home in Northern Ireland is often simple for Irish citizens.³

When applying to rent a property landlords are generally interested in your finances, in particular things like your credit score and financial stability. You’ll want to have this in order when you start your property search to increase your chance of finding a rental quickly.

If you’re accepted as the new tenant you’ll be asked to sign a rental agreement. In Northern Ireland this is usually a private tenancy agreement between you and the landlord. You’ll also be asked for a refundable deposit which by law must be secured under the tenancy deposit protection scheme.

To get you started, here’s a few sites you can use to search for available rental properties in Northern Ireland:

There’s also a number of real estate agencies who advertise the homes they have available on their websites.

The cost of rent can play a big factor in deciding which city to live in, so here’s a comparison of average apartment rental prices in the cities of Belfast, Derry, Bangor and Newry.

| Property | Belfast⁴ | Derry⁴ | Bangor⁵ | Newry⁵ |

|---|---|---|---|---|

| 1 bedroom apartment (city centre) | €989.05 | €598.53 | €520.55 | €694.07 |

| 1 bedroom apartment | €733.23 | €514.70 | €462.72 | €520.55 |

| 3 bedroom apartment (city centre) | €1,567.45 | €860.78 | €1,388.15 | €983.27 |

| 3 bedroom apartment | €1,025.86 | €754.90 | €1,012.19 | €867.59 |

This is only a rough idea but as you can see Belfast is generally more expensive than the other cities. That being said, prices do fluctuate depending on the current market, neighbourhood and the size and interior of the building.

As we mentioned before, the Wise Account can help you manage the financial side of your international relocation without the added stress of needing to move to Northern Ireland before you can open an account.

After opening an account and getting your Wise debit card, you can arrive in Northern Ireland already spending in the local currency and being able to receive money like a resident due to the local account details in GBP.

And if you need to transfer money between countries, Wise always uses the mid-market rate with just a small variable fee, so you likely can save a bit of money when compared to using your normal Irish bank.

Sources used:

Sources last checked on date: 24 July 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of moving to the UK from Ireland? Check this comprehensive guide on how to go about it.