Importing from Spain to the UK: Complete Business Guide

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

Online sales are at an all time high¹, and today’s customers expect a fast, convenient shopping experience. As a business owner, you’ll want to maximise your online offering and provide your customers with an easy-to-use and secure online payment system.

In this article, we'll discuss some of the options you can consider, their pros and cons together with the fees. We'll also leave you with a handy tip on how to protect your profit when selling internationally!

Credit or debit cards are the most commonly used online payment methods. Mobile consumer wallets, like Apple Pay or Google Pay, are also increasingly popular. When choosing a payment system, consider business needs, budget, and also what payment options are included.

Worldpay offer an online payment gateway and merchant account for business owners who want a straightforward payment solution with no extra features.²

| Service | Fees³ |

|---|---|

| Fixed monthly fee | From £19 - Standard planFrom £45 - Advanced plan |

| Pay as you go⁴ | 2.75% + 20p |

| Setup costs | None |

| PCI compliance certification annual fee | £29.99 |

| Pros | Cons |

|---|---|

|

|

If you want technological support, Shopify can help you build an online presence. They provide a full ecommerce solution, with a range of packages offering web hosting and access to sales channels like Amazon.

| Service | Fees⁵ |

|---|---|

| Fixed monthly fee | $29 - Basic Shopify$79 - Shopify$299 - Advanced Shopify |

| Online Transaction fees | 2.2% + 20p - Basic Shopify1.9% + 20p - Shopify1.6% + 20p - Advanced Shopify |

| Currency conversion (for payments in different currency)⁶ | 1.5% in the US 2% rest of the world |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

Stripe’s popular offer includes payment processing at competitive rates, with straightforward, upfront pricing. However, you’ll need your own website or shopping cart software.

| Service | Fees⁷ |

|---|---|

| Fixed monthly fee | None |

| Transaction fee for European cards | 1.4% + 20p |

| Transaction fee for non-European cards | 2.9% + 20p |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

Previously Sage Pay, Opayo is one of Trustpilot’s highest rated UK online payment providers. Their offer includes a merchant account and payment processing, but you must have a website.

| Service | Fees⁸ |

|---|---|

| Fixed monthly fee | From £25 - Flex plan (up to 350 transactions p/m)From £45 - Plus plan (9p charge per transaction after 350 transactions p/m) |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

PayPal is the most familiar online payment system. They offer a fast and secure way of accepting payments, as many customers will already have a PayPal account.

| Service | Fees¹⁰ |

|---|---|

| Fixed monthly fee | None |

| Domestic online transaction fee | 2.90% + 30p |

| International online transaction fee | 2.90% + 30p (+ 0.50% - 2% region dependent) |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

Adyen offers a competitively priced payment system, and includes big names, such as eBay and Spotify, among their customers. However, they’re geared towards businesses with higher sales volumes.

| Service | Fees¹¹ |

|---|---|

| Fixed monthly fee | None |

| Online Transaction fees* | Visa £0.10 + interchange++Mastercard £0.10 + interchange++American Express £0.10 + 3.95% |

| Setup costs | None |

*Adyen uses pricing model Interchange++, which tracks Interchange rates and scheme fees down to transaction level.

| Pros | Cons |

|---|---|

|

|

Amazon Pay, from the online retail giant, allows customers to make payments using their Amazon account, without leaving your site. The service is convenient but is still relatively young, having only started in the UK in 2017.

| Service | Fees¹² |

|---|---|

| Fixed monthly fee | None |

| Domestic Transaction fees | 2.7% + £0.30 (up to £50,000 p/m) |

| International Transaction fees | 2.7% + £0.30 + country-specific fee of 0.4% - 1.5% |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

The digital wallet and money transfer specialist offers payment processing for businesses. They provide a merchant account and integration with leading shopping carts.

| Service | Fees¹³ |

|---|---|

| Merchant account | Free |

| Transaction fees | Quote provided based on business model |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

A provider of online payment solutions aimed at helping small businesses grow. Their services include a simple ecommerce website or a checkout without a website.

| Service | Fee¹⁵ |

|---|---|

| Fixed monthly fee | None |

| Transaction fee for European cards | 1.9% |

| Transaction fee for non-European cards | 2.9% |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

A division of PayPal, Braintree specialises in flexible payment options. Their service includes a merchant account and payment gateway.

| Service | Fees¹⁷ |

|---|---|

| Fixed monthly fee | None |

| Transaction fee for EU/EEA cards & digital wallets | 1.9% + £0.20 |

| Transaction fee for non-EU/EEA cards | 1.9% + £0.20 + 1% |

| Setup costs | None |

| Pros | Cons |

|---|---|

|

|

As you can see, international payments can be quite expensive with most payment providers due to hefty fees and poor exchange rates but there’s a way to reduce the cost.

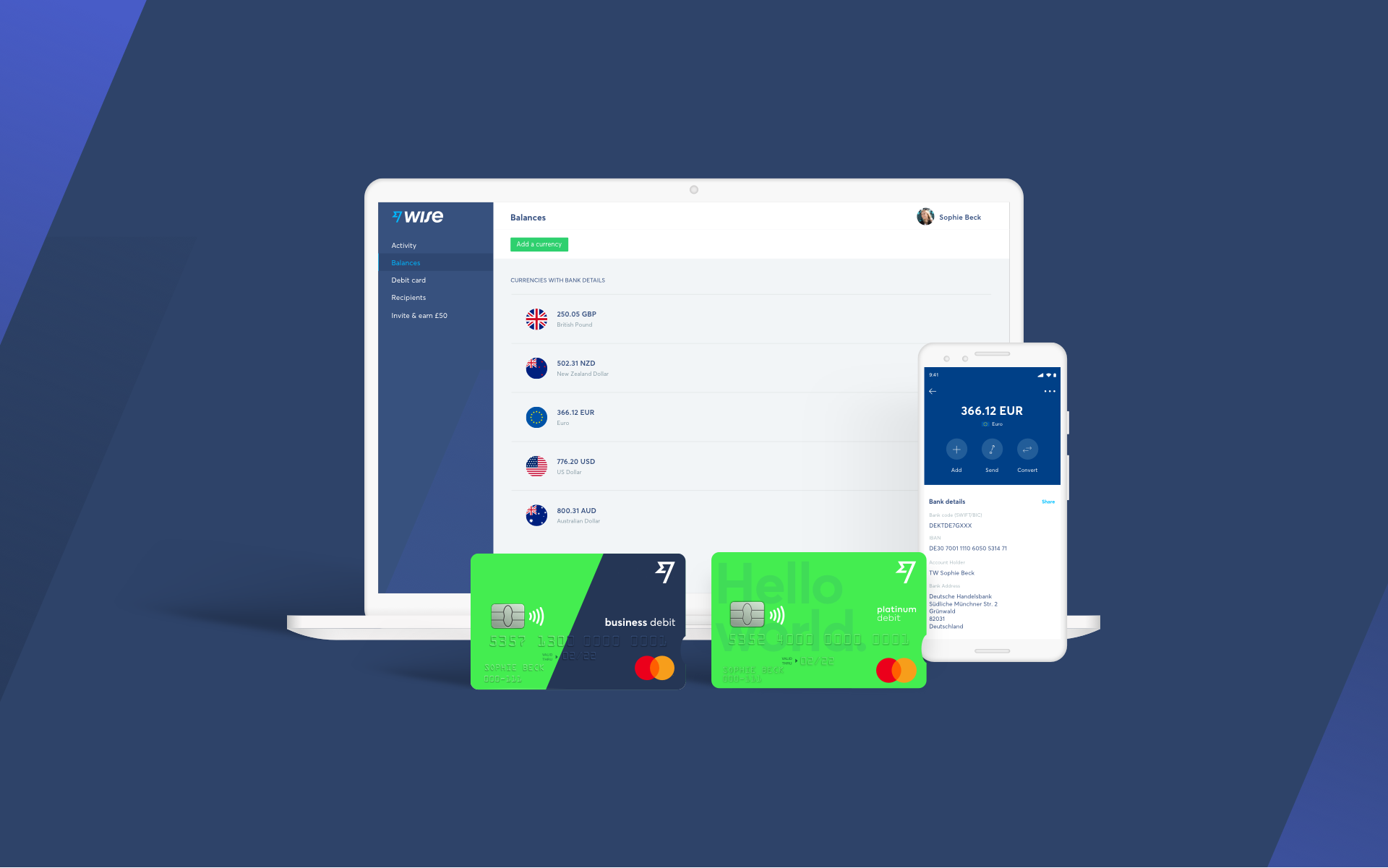

Open a Wise Business account and use it to receive payments from your payment processor to avoid exchange rate mark-ups and take advantage of currency conversions at the mid-market rate for a small, transparent fee.

Summary

So there’s 10 reputable online payment systems to start your search. Before deciding, take time to consider if you need an ecommerce package or just the payment gateway - if you want to avoid fixed fees and to prioritise giving customers flexibility over how they pay.

Remember to explore free trials and any tailored quotes before you make your choice.

Sources used for this article:

Sources checked on 28-July-2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

Read our complete business guide on importing from Türkiye to the UK, covering everything from customs to shipping methods.

Is Tide Bank safe? Find out everything you need to know about Tide Bank business account security here.

Is Revolut Business safe? Find out everything you need to know about Revolut UK security here in our helpful guide.

Read our helpful guide on how to start a business in Romania from the UK, including info on company formation, legal entity types and required documents.

Read our helpful guide on how to start a business in Lithuania from the UK, including info on Lithuania company formation, legal entity types and more.