Importing from Spain to the UK: Complete Business Guide

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

Net income (also called ‘net profit’ or ‘net earnings’) is a measure of how much much money a business makes minus the money spent to help it operate in one fiscal period.

After a business’s costs from the purchase of inventory, selling, general and administrative costs, interest, depreciation, taxes, etc. are all deducted from revenues, the final figure is net income. It's one of - if not the most important metrics when looking at the performance and overall health of your business' finances.

The net income is the last line item on an income statement (also called a statement of Profit and Loss). As such, when someone refers to a company’s ‘bottom line’, they are talking about the net income that the company generated during the period.

| 🌎💸 Reduce your operational cost and increase net income - get Wise today! |

|---|

Net income is one of the most fundamental metrics that business owners, investors, and finance teams will use to help make big important decisions about the future strategy of a business. Unlike other metrics such as gross profit, operating profit, and pre-tax profit, net income accounts for the sales that are still remaining after all other expenses have been paid during a period.

This provides a good degree of insight into:

a) whether the business makes more money than it spends i.e. whether it is profitable or not, and

b) what proportion of each dollar/pound of revenue earned is ultimately keep inside the business and its shareholders after paying all expenses.

From a business owner standpoint, net income is highly useful for evaluating the financial health of the business, and understanding what changes need to be made in the business to improve profitability in the future. It is also useful for making decisions such as how much money can be paid out as dividends to shareholders, applied towards debt repayments, reinvested into the business, or simply saved for the future.

Net income and Gross Income are two distinct line items on an income statement. However, since gross income is used to calculate net income, the two terms are easy to confuse.

However, gross income is the total amount earned by a business after accounting for the total costs of purchase and production of the goods and/or services sold, but before factoring in any other expenses. On the other hand, Net Income is the remaining amount after all expenses have been paid as mentioned previously.

A key concept to understand here is the ‘Cost of Goods Sold’ (‘COGS’ for short). COGS refers to the direct costs that are incurred by a business when producing the goods and services that will ultimately be sold to earn revenue.

This may include the cost of raw materials, transportation, labour etc. that go into getting the product ready for sale. The gross income therefore represents the surplus of revenues above COGS.

| 💡 It is important to note that a business also incurs other costs besides those used directly in the production of the good or service. These include costs such as the salaries of its people, marketing, distribution, taxes, interest paid on credit facilities etc. The net income represents the surplus of revenues above all of these costs, including COGS. |

|---|

To illustrate the above, let’s take the example of a small business with:

As can be seen in the above income statement, there are a few steps that you have to take before you arrive at the final net income amount.

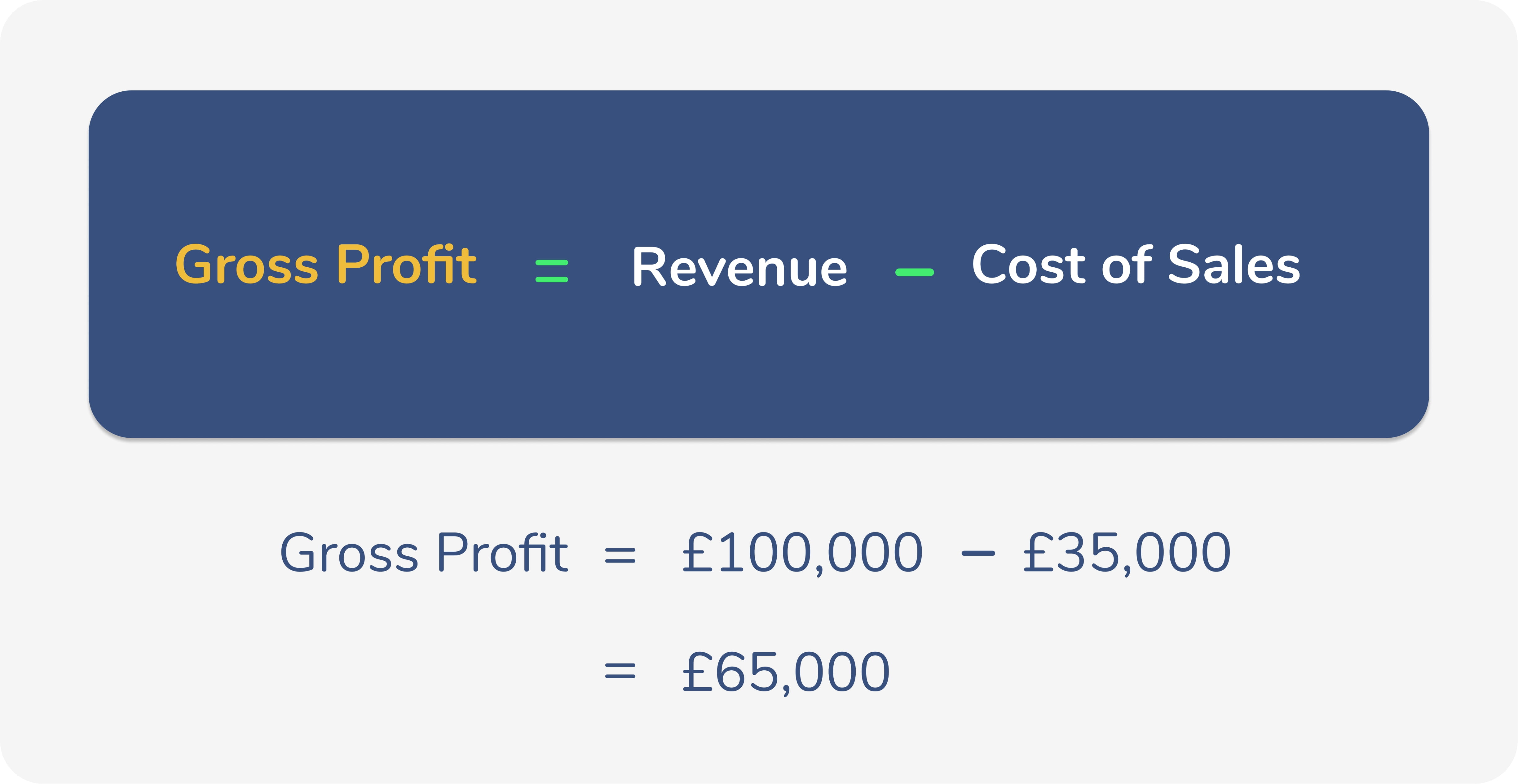

1. Calculate the gross profit. As explained above, this means reducing revenues by the amount it takes to produce and get the goods or services ready for sale. The calculation for gross profit is follows:

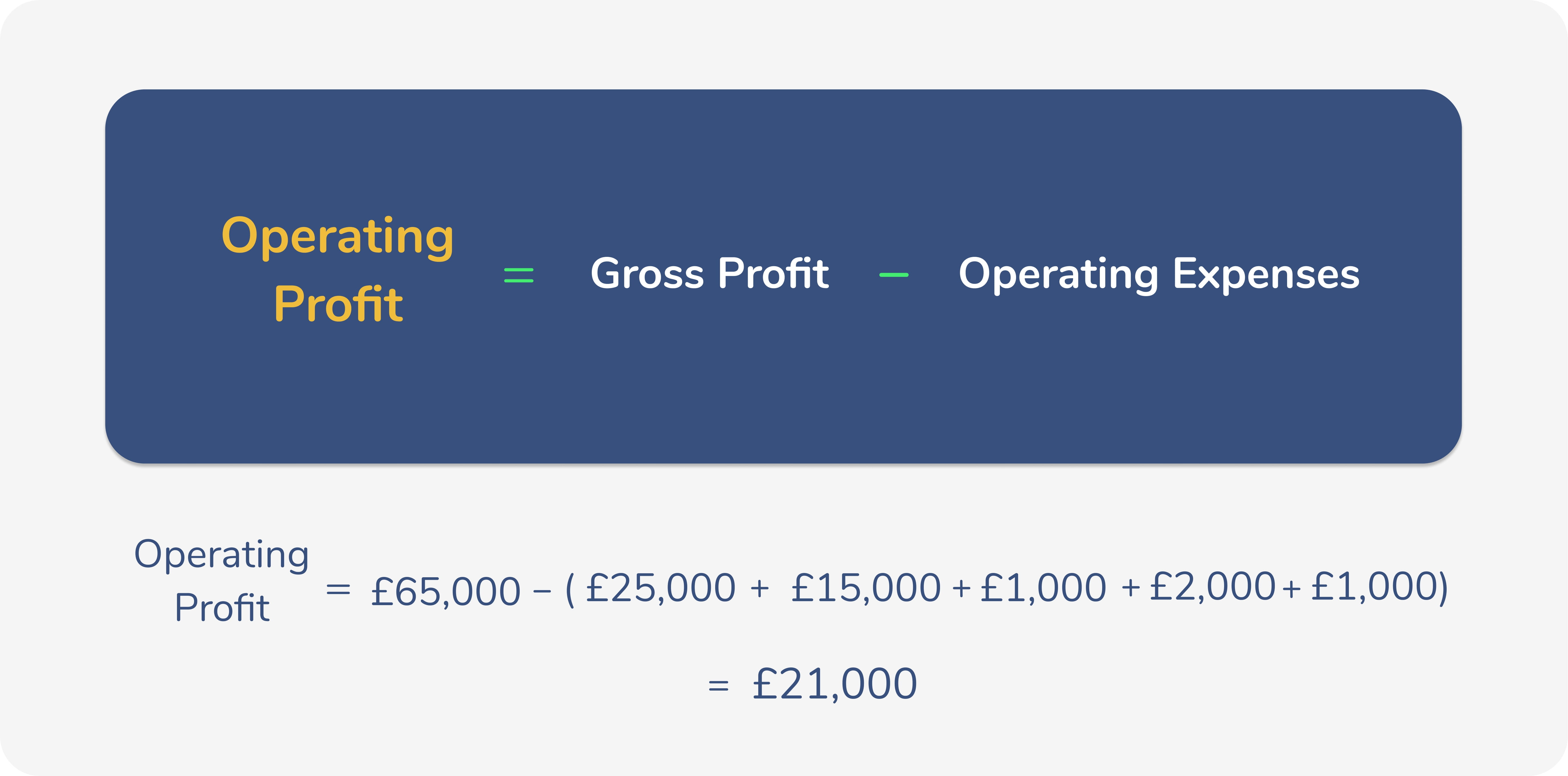

2. Next, we have to deduct the other operating expenses (i.e. the indirect costs that a business pays over and above what it costs to produce the goods or services it produces). This results in the operating profit, which is calculated as follows:

3. The final step is to deduct interest and taxes. We subtract interest expenses first to get pre-tax income which is the income generated by the business after accounting for all its costs except for taxes.

This is a useful metric for understanding the profitability of the business without accounting for forces outside of its control (i.e. the tax rate which is set by the government of the jurisdiction the business operates in).

The tax rate is then applied to this pre-tax income to determine the total taxes that the company owes at the end of the period. The final amount remaining is net income.

As a business ventures internationally into new territories, the added scale brings with it various financial and operational challenges. From a financial standpoint, some of the hurdles may involve having to make payments in a different currency than the home country, as well as operating multiple bank accounts across various jurisdictions to make and receive payments to suppliers and employees.

These challenges can cause a business to incur additional costs such as the FX fees paid to convert between different currencies, and bank charges paid for receiving funds in a different currency. Solutions like Wise-Multi-currency Account can help streamline financial management as it lets you can manage different currencies in one account. It's also secured and cost-effective so you can cut-cost on some of your overseas payments.

Notwithstanding these challenges, it is absolutely critical that business owners and management teams plan and manage their international finances prudently. This can help to avoid administrative expenses such as the ones mentioned above, missed payments, inaccurate financial statement preparation, and regulatory penalties, amongst other consequences of improper financial management.

While there are many ways to improve net profit from increasing revenues to reducing key operating expenses, a solution can be as easy as saving money on international payments. You may be wondering how.

It’s pretty simple. With a Wise multi-currency account, you can make or receive payments from international accounts in 10 currencies for free! This saves you the cost of added charged FX fees to convert inbound/outbound funds. In addition, converting between different currencies is up to 80% cheaper than going via traditional routes such as banks.

A Wise multi-currency account also offers the benefits of convenience whereby payments can easily be tracked via the website or the specialist Wise app, and multiple payments can be made at once using the batch payment feature.

Reach out to our team today to learn more about a multi-currency account, and find out how Wise could save you money.

Final Thoughts

Net income is arguably one of the most important gauges of financial health for a business and its stakeholders. As the final line on the income statement, it shows how much of a business’s revenues is ultimately converted to profit once all expenses have been paid.

A business with an international presence faces several incremental expenditures relating to international financial management that can reduce net income meaningfully if not managed properly. However, taking proactive steps such as selecting the right payment provider and establishing multi-currency accounts can help your business scale internationally without adversely impacting the bottom line.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

Read our complete business guide on importing from Türkiye to the UK, covering everything from customs to shipping methods.

Is Tide Bank safe? Find out everything you need to know about Tide Bank business account security here.

Is Revolut Business safe? Find out everything you need to know about Revolut UK security here in our helpful guide.

Read our helpful guide on how to start a business in Romania from the UK, including info on company formation, legal entity types and required documents.

Read our helpful guide on how to start a business in Lithuania from the UK, including info on Lithuania company formation, legal entity types and more.