China income tax rate for foreigners: how to calculate?

Check out how the Chinese tax system works for expats working in China. How to calculate China's individual income tax rate and corporate/business tax rate?

When visiting China or moving to China, managing finances is a concern for many. While credit cards and traveler's checks are useful for overseas visitors to China, it is a Chinese bank account that seems to be a must for foreigners studying or working in China. You’ll need a bank account to withdraw Chinese Yuan, and make international money transfers. Additionally, you usually have to receive your salary, pay your school fees and medical bills using your bank account.

Many expats choose to open an account with the Bank of China (BOC), the leading commercial bank in China. It is advisable to find out in advance the specific requirements and procedures of the BOC bank branch in your city. The requirements for foreigners to apply for an account may vary from place to place.

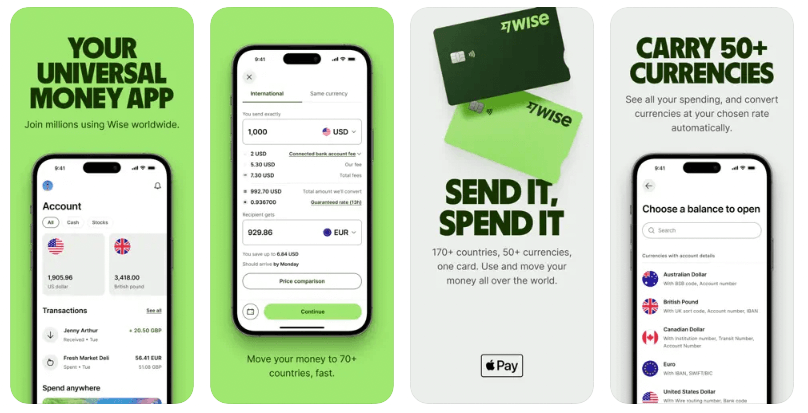

To make managing finances abroad more easily, we suggest opening a Wise account. It enables you to receive and send money from and to 160+ countries, including China. Also, it will be easy to pay for your house rent, grocery list, and other expenses with a Wise debit card.

So let’s look at topic at hand -- how to open a Bank of China account as a foreigner, with complete online and onsite instructions.

Open Wise multi-currency account today

Yes, you can. Bank of China welcomes foreign nationals to open an account, provided they can provide proper documents and meet the bank's requirements. It is your choice to open a personal account for personal banking or a corporate account for business banking¹.

Valid passport or permanent residence permit for foreigners

If you hold a passport for account opening, the Bank of China will check the visa type of the passport.

The bank will only open an account for you when the visa type is Settlement, Resident Correspondent, Trade, Long-term Family Visit, Talent, Long-term Private Affairs, Long-term Study, Tenure Employment, Courtesy Visa, Diplomatic Visa, and you can present the corresponding supporting documents (e.g., work permit, motor vehicle driver's license, social security card, public utility bill, student ID card, letter of introduction, letter of invitation, or any other valid documents or certificates that can prove the identity of the applicant).

Please note:

Branches of the Bank of China in different cities have their own eligibility criteria. So make sure you consult the local branch in your city.

If you are opening a business account with the Bank of China, proof of the business’s proper registration, names of directors, the company seal, proof of identity for the legal representatives of the business, and some other documents are required.

The Bank of China offers credit cards and debit cards according to whether or not the cardholder is granted access to credit lines².

Based on their respective purposes, debit cards are separated into three categories: transfer, specialized, and stored value cards. Debit cards can be used for money transferring, cash accessing and spending. ATM transfers and withdrawals are possible with debit cards, but overdraft protection is not available. You can also link a debit card to a third-party payment method such as Alipay or WeChat Pay.

As for credit accounts, there are credit cards and quasi-credit cards. The former means that the Bank of China grants the cardholder a certain credit limit, within which the cardholder can spend first and repay later. The latter is a credit card in which the cardholder first deposits a certain amount of reserve as required by the bank, and when the reserve is insufficient for payment, the cardholder can overdraw within the credit limit stipulated by the Bank of China.

How long does it take?

It depends on the length of queues at the local bank on the day and staff processing times.

How much do I need to open a Bank of China account?

Some cash is necessary, as you need to pay the bank card that costs up to 5 yuan/card³, and the initial deposit that must be more than or equivalent to ¥1 Yuan.

The good news is that the Bank of China has abolished the annual fee for personal debit cards and the management fee for RMB personal small demand deposit accounts since February 2022⁴.

Foreign nationals are unable to open a Bank of China account online through the official website, in-app or Wechat official account of BOC. You will have to go to the bank in person.

Do be aware that opening a Bank of China account online is an digital card. If you need a physical card, you still need to bring the required documents to the Bank of China branch.

Among all banks in China, Bank of China has the most overseas branches, with a total of 643 foreign branches in 28 countries and areas⁶, including the US, Canada, Grand Cayman, Panama, Brazil, Hong Kong, Macau, Taiwan, Singapore, Japan, Kazakhstan, Korea, Malaysia, Australia, Thailand, Vietnam, the Philippines, Cambodia, Indonesia, the Emirate of Dubai, Kingdom of Bahrain, Mongolia, UK, Luxembourg, Netherlands, Belgium, Poland, Sweden, France, Germany, Italy, Hungary, Russia, Abu Dhabi, Zambia, South Africa, and Kenya⁷.

In addition, it has established global clearing centers in New York, London, Frankfurt, Tokyo, and other currency hubs, and maintains correspondent banking connections with banks in all main countries in the world ⁶.

Here below we just list some of the BOC foreign branches, click for thefull list:

For an expat, one important thing when you open a bank account in China is to make international transfers, whether it is to receive funds from abroad or send money out of China. And there are a few you may be concerned about.

What currency rates do banks in China use?

All banks in the world, including Chinese banks, set their own rate. There is usually a buy rate and a sell rate for banks to make profit when processing financial transactions for their customers. But is there a fair rate? Yes, there is. Themid-market rate -- the middle point between a buy and a sell rate is acknowledged to be the fairest rate.

How long does it take to make an international transfer with the Bank of China?

It takes three to five working days for the funds to arrive at the destination account abroad.

And the foreign receiving bank (including transfer bank) will generally process the transfer within the next one to two working days.

What document do you need to take with you?

Your valid passport and any other necessary credentials.

As the requirements and procedures for cross-border RMB outward remittance services are complicated, please consult your local branch directly for exact details.

What forms need to be filled out to make a wire transfer via Bank of China?

What are the limits for each international transfer?

The single limit for foreigners to remit abroad with the Bank of China is USD 50,000. If the limit is exceeded, it is necessary to hold documents proving the transaction amount and the Tax Filing Form for Foreign Payment of Service Trade and Other Items stamped by the competent tax authority.

Wiseis an alternative to using a Chinese bank account when it comes to making international transfers and converting currencies. Why? Wise users can hold and convert more than 40 currencies, including RMB, and can send RMB money out of China to 160+ countries!

Wise makes handling your money while living and working in China very convenient and cheap.

Opening a Wise account in China takes little effort or stress. You don’t have to go to a physical bank, queue up, and wait for manual processing. Join 16 million Wise users globally today!

_ *This service is provided in partnership with a licensed third-party payment provider in China._

Open Wise multi-currency account today

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out how the Chinese tax system works for expats working in China. How to calculate China's individual income tax rate and corporate/business tax rate?

A popular digital payment methods in China, Alipay can be an essential for any expats in China. You might need to know how to add Alipay to Apple Pay.

There are many benefits to being a permanent resident in China. But foreigners need to meet the requirements to apply for a Chinese permanent residency.

A guide to the social credit system in China for foreigners to understand how it works, how to check your records, the penalties and rewards in the Chinese soci

Is there an English version of Taobao? How to change Taobao to English? Learn from this step-by-step guide plus the relationship between Ali Express and Taobao.

With our guide on how to buy from Taobao, you can easily find items you want and buy them, and find out if you can buy from Taobao directly as a foreigner.